1. Cobb Company's current receivables from affiliated companies at December 31, 2011, are (1) a $75,000 cash...

Question:

1. Cobb Company's current receivables from affiliated companies at December 31, 2011, are (1) a $75,000 cash advance to Hill Corporation (Cobb owns 30 percent of the voting stock of Hill and accounts for the investment by the equity method), (2) a receivable of $260,000 from Vick Corporation for administrative and selling services (Vick is 100 percent owned by Cobb and is included in Cobb's consolidated financial statements), and (3) a receivable of $200,000 from Ward Corporation for merchandise sales on credit (Ward is a 90 percent-owned, unconsolidated subsidiary of Cobb accounted for by the equity method). In the current assets section of its December 31, 2011, consolidated balance sheet, Cobb should report accounts receivable from investees in the amount of:

a. $ 180,000

b. $ 255,000

c. $ 275,000

d. $ 535,000

Use the following information in answering questions 2 and 3.

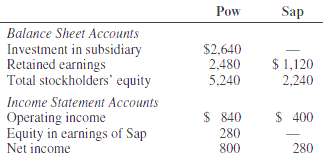

On January 1, 2011, Pow Corporation purchased all of Sap Corporation's common stock for $2,400,000. On that date, the fair values of Sap's assets and liabilities equaled their carrying amounts of $2,640,000 and $640,000, respectively. Pow's policy is to amortize intangibles other than goodwill over 10 years. During 2011, Sap paid cash dividends of $40,000. Selected information from the separate balance sheets and income statements of Pow and Sap as of December 31, 2011, and for the year then ended follows (in thousands):

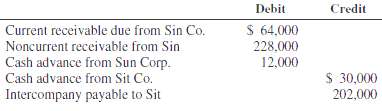

2. In Pow's 2011 consolidated income statement, what amount should be reported for amortization of goodwill?a. $ 0b. $ 24,000c. $ 36,000d. $ 40,0003. In Pow's December 31, 2011, consolidated balance sheet, what amount should be reported as total retained earnings?a. $ 2,480,000b. $ 2,720,000c. $ 2,760,000d. $ 3,600,0004. Pop Corporation has several subsidiaries that are included in its consolidated financial statements. In its December31, 2011, trial balance, Pop had the following intercompany balances before eliminations:

In its December 31, 2011, consolidated balance sheet, what amount should Pop report as inter-company receivables?a. $ 304,000b. $ 292,000c. $ 72,000d. $0

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith