Question: a. 1. The statement is entitled Consolidated Balance Sheets.'' What does it mean to have a consolidate balance sheet? 2. For subsidiaries where control is

a. 1. The statement is entitled ‘‘Consolidated Balance Sheets.'' What does it mean to have a consolidate balance sheet?

2. For subsidiaries where control is present, does Kellogg have 100% ownership? Explain.

3. Are there subsidiaries where control is not present? Explain.

b. 1. With this information, can the gross receivables be determined? Explain.

2. What is the estimated amount that will be collected on receivables outstanding at the end of 2008?

c. 1. What is the total amount of inventory at the end of 2008?

2. What indicates that the inventory is stated on a conservative basis?

3. What is the trend in inventory balance? Comment.

d. 1. What is the net property and equipment at the end of 2008?

2. What depreciation method is used for financial reporting purposes? Where permitted, what depreciation methods are used for tax reporting? Comment on why the difference in depreciation methods for financial reporting versus tax reporting.

3. What is the accumulated depreciation on land at the end of 2008?

e. 1. Describe the treasury stock account.

2. What method is used to record treasury stock?

3. Why is treasury stock presented as a reduction in stockholders' equity?

f. 1. What is the fiscal year?

2. Comment on the difference in length of fiscal year.

g. 1. Comment on the use of estimates.

h. 1. Does it appear that cash and cash equivalents are presented conservatively?

i. 1. Comment on the source of goodwill.

2. How are goodwill and indefinite-lived intangibles handled for write-offs?

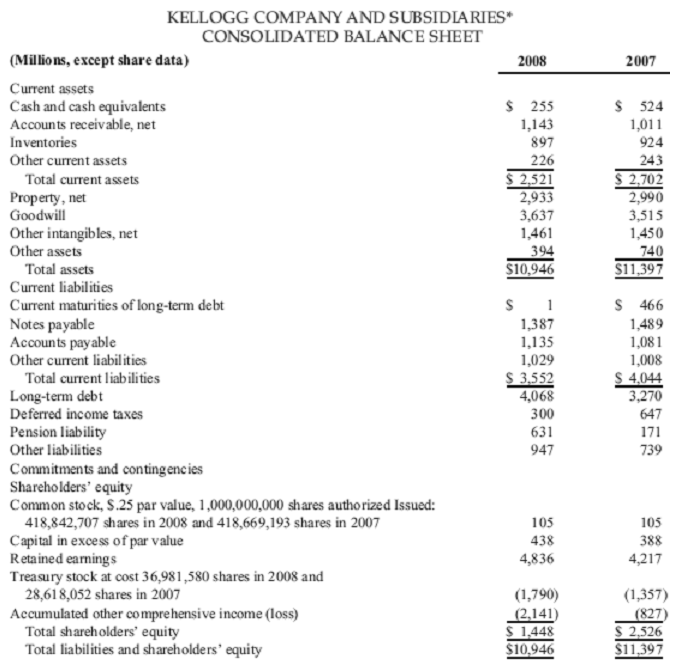

KELLOGG COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (Millions, except share data) Current assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets 2008 2007 S 255 1,143 897 S 524 1,011 924 243 S 2.702 2,990 3,515 1450 740 $11.397 Total current assets S 2.521 2,933 3,637 1,461 394 S10.946 Property, net Goodwill Other intangibles, net Other assets Total assets Current liabilities Current maturities of long-term debt Notes payable Accounts payable Other current iabilities S 466 1.489 1,081 1,008 Total current liabilities Long-term debt Deferred income taxes Pension liability Other liabilities Commitments and contingencies Shareholders' equity Common stock, S.25 par value, 1,000,000,000 shares authorized Issued: 1,387 1,135 1,029 3.552 4,068 300 631 947 3,270 647 739 418,842,707 shares in 2008 and 418,669,193 shares in 2007 Capital in excess of par value Retained earnings Treasury stock at cost 36,981,580 shares in 2008 and 105 438 4,836 105 388 4,217 28,618,052 shares in 2007 (1,790) -2140 (1,357) (827) Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity S10,946

Step by Step Solution

3.47 Rating (180 Votes )

There are 3 Steps involved in it

a 1 The financial statements of the parent and the subsidiary are consolidated A subsidiary is a com... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

139-B-A-B-S-C-F (756).docx

120 KBs Word File