A factory costs $400,000. You reckon that it will produce an inflow after operating costs of $100,000

Question:

A factory costs $400,000. You reckon that it will produce an inflow after operating costs of $100,000 in year 1, $200,000 in year 2, and $300,000 in year 3. The opportunity cost of capital is 12 percent. Draw up a worksheet like that shown in Table 3.1 and use tables to calculate theNPV.

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

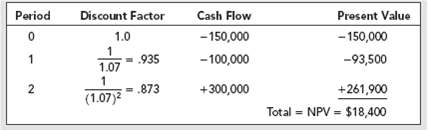

Discount Factor Period Cash Flow Present Value - 150,000 1.0 -150,000 .935 1.07 - 935 -100,000 -93,500 (1.07)2 2 -.873 +300,000 +261,900 Total = NPV = $18,400 %3D

Step by Step Answer:

Period 0123 0 2 3 Discount Fac...View the full answer

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

A factory costs $400,000. It will produce an inflow after operating costs of $100,000 in year 1, $200,000 in year 2, and $300,000 in year 3. The opportunity cost of capital is 12%. Calculate the NPV.

-

A factory costs $800,000. You reckon that it will produce an inflow after operating costs of $170,000 a year for 10 years. If the opportunity cost of capital is 14 percent, what is the net present...

-

A factory costs $400,000. You forecast that it will produce cash inflows of $ 120,000 in year 1, $180,000 in year 2, and $300,000 in year 3. The discount rate is 12%. Is the factory a good...

-

The S&P portfolio pays a dividend yield of 1% annually. Its current value is 1,300. The T-bill rate is 4%. Suppose the S&P futures price for delivery in 1 year is 1,330. Construct an arbitrage...

-

The age of the Dead Sea Scrolls was found by carbon dating. Could this technique apply if they were carved in stone tablets? Explain.

-

Find proj v u and scal v u by inspection without using formulas. 4

-

Today, nearly all cable companies carry at least one home shopping channel. Who uses these home shopping services? Are the shoppers primarily men or women? Suppose you want to estimate thc difference...

-

How might an international firm trying to adapt HRM practices to the local culture produce worse results than it would produce by "exporting" HRM practices from the home office?

-

Prepare journal entries to record the following merchandising transactions of Allen's, which uses the perpetual inventory system and the gross method. (Hint: It will help to identify each receivable...

-

1. The weights of all babies born at a hospital have a mean of 7.4 pounds and a standard deviation of 0.66 pounds. Assuming (n/N less than 0.05), the standard deviation of the sampling distribution...

-

Harold Filbert is 30 years of age and his salary next year will be $20,000. Harold forecasts that his salary will increase at a steady rate of 5 percent per annum until his retirement at age 60. a....

-

Halcyon Lines is considering the purchase of a new bulk carrier for $8 million. The forecasted revenues are $5 million a year and operating costs are $4 million. A major refit costing $2 million will...

-

Internet sites that enable people to post their resumes online reduce the costs of job searches. How do you think the Internet has affected the natural rate of unemployment?

-

a) Describe the following concepts in the context of organizational development. b) Discuss how these concepts interrelate and support each other within an organizational framework

-

Q2. a) Analyze the importance of communication in the change management process. b) Suggests strategies that a Disaster Management Organization can employ to ensure effective communication during...

-

Q3. a) Explain the following Change Management Models

-

Q3. b) Discuss how each model can be applied in real-world organizational change scenarios.

-

In this question, you will work step-by-step through an optimization problem. A craftsman wants to make a cylindrical jewelry box that has volume, V, equal to 55 cubic inches. He will make the base...

-

Advertisements for new salespersons develop greater responses when the copy is not very specific. T F

-

Based on the scenario described below, generate all possible association rules with values for confidence, support (for dependent), and lift. Submit your solutions in a Word document (name it...

-

The ironchromium redox battery makes use of the reaction occurring at a chromium anode and an iron cathode. (a) Write a cell diagram for this battery. (b) Calculate the theoretical voltage of the...

-

Look back at the Merck example in Section 18-1. Suppose Merck increases its long-term debt to $10 billion. It uses the additional debt to repurchase shares. Reconstruct Table 18.3(b) with the new...

-

Let us go back to Circular Files market value balance sheet: Who gains and who loses from the following maneuvers? a. Circular scrapes up $5 in cash and pays a cash dividend. b. Circular halts...

-

I was amazed to find that the announcement of a stock issue drives down the value of the issuing firm by 30 %, on average, of the proceeds of the issue. That issue cost dwarfs the underwriters spread...

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

-

NEED THIS EXCEL TABLE ASAP PLEASE!!!! Presupuesto Operacional y C lculo del COGS Ventas Proyectadas: Ventas Proyectadas: $ 4 5 0 , 0 0 0 Precio por unidad: $ 4 5 0 Unidades vendidas: 4 5 0 , 0 0 0 4...

-

The wash sale rules apply to disallow a loss on a sale of securities_______? Only when the taxpayer acquires substantially identical securities within 30 days before the sale Only when the taxpayer...

Study smarter with the SolutionInn App