A financial institution has hired three external portfolio managers: X, Y, and Z. All three managers have

Question:

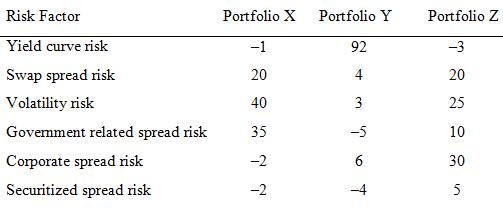

A financial institution has hired three external portfolio managers: X, Y, and Z. All three managers have the same benchmark. A performance attribution analysis of the portfolios managed by the three managers for the past year was (in basis points):

The financial institution’s investment committee is using the above information to assess the performance of the three external managers. Below is a statement from three members of the performance evaluation committee. Respond to each statement.

(a) Committee member 1: “Based on overall performance, it is clear that manager Y was the best performing manager given the 96 basis points.”

(b) Committee member 2: “All three of the managers were hired because they claimed that they had the ability to capitalize on corporate credit opportunities. Although they have all outperformed the benchmark, I am concerned about the claims that they made when we retained them.”

(c) Committee member 3: “It seems that managers X and Z were able to outperform the benchmark without taking on any interest rate risk at all.”

Step by Step Answer: