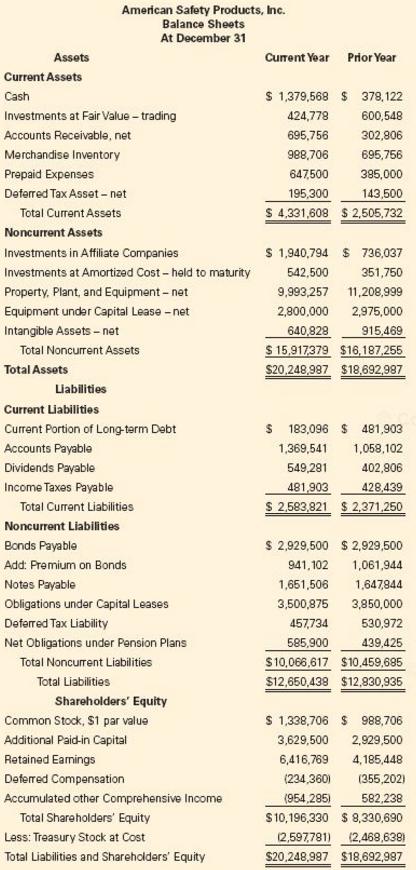

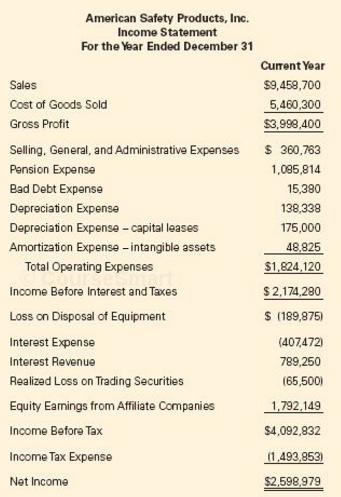

American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year.

Question:

American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year.

Additional Information:

1. American Safety Products sold trading securities at a loss.

2. The company sold one of its franchises at cost.

3. American Safety Products sold plant assets with a carrying value of $ 1,077,404 for a loss of $ 189,875.

4. American Safety Products made debt payments to reduce the current portion of long- term debt and capital lease obligations. American Safety Products borrowed an additional $ 3,662 by issuing a long-term note.

5. The change in AO CI is due to adjustments required for the company’s defined- benefit pension plan.

6. American Safety Products acquired additional securities classified as held to maturity. It did not purchase any other investments during the year.

7. American Safety Products did not reissue any treasury stock

8. Treat the trading securities as an investing activity. 9. Ignore the amortization of the held- to- maturity investment.

Required

Prepare the cash flow statement for American Safety Products for the current year using the indirect method. Provide all required disclosures.

American Safety Products, Inc. Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Investments at Fair Value trading Accounts Receivable, net Merchandise Inventory Prepaid Expenses Deferred Tax Asset- net S 1,379,568 S 378,122 424,77 600,548 65,758 30 306 988,706 695,756 647500 385,000 95,300 143,500 S 4,331,608 2,505,732 Total Current Assets Noncurrent Assets Investments in Affiliate Companies Investments at Amortized Cost held to maturity Property, Plant, and Equipment net Equipment under Capital Lease -net Intangible Assets-net S 1,940,794 736,037 351,750 542,500 9,893,257 11,20,9e 2.800,000 2.975,000 40,828915459 Total Noncurrent Assets Total Assets S20.248.997 $18.692.987 Liabilities Current Liabilities Current Portion of Long-term Debt Accounts Payable Dividends Payable Income Taxes Payable S 183,096 481,903 1,369,541 1,058,102 549281 402,806 481.903428439 Total Current Liabilities Noncurrent Liabilities Bonds Payable Add: Premium on Bonds S 2,583,821 $2,371,250 s 2,929,500 2,929,500 941.102 ,061,944 1,651,506 1,647844 3,500,875 3,850,000 457,734 530,972 439,425 $10,066,617 $10,459,685 $12,650,438 $12.,830,935 Obligations under Capital Leases Deferred Tax Liability Net Obligations under Pension Plans Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Deferred Compensation Accumulated other Comprehensive Income S 1,338,706 S 988,706 3,629,500 2,929,500 6,416,769 4,185,448 234,360 (355,202) 954,285) 582,238 S10,196,330 $ 8,330,690 口597781) 12,468,6381 S20.248.987 $18,692,987 Total Shareholders' Equity Less: Treasury Stock at Cost Total Liabilities and Shareholders Equity American Safety Products, Inc. Income Statement For the Year Ended December 31 Sales Cost of Goods Sold Gross Profit Current Year 59,458,700 5,460,300 $3,998.400 Selling, General, and Administrative Expenses 360,763 1,085,814 15,380 138,338 175,000 48,825 $1,824.120 2,174,280 S (189.878 407472 789,250 65,500 1,792,149 $4,092,832 1,493,853) $2,598,979 Pension Expense Bad Debt Expense Depreciation Expense Depreciation Expense capital leases Amortization Expense -intangible assets Total Operating Expenses Income Before Interest and Taxes Loss on Disposal of Equipment Interest Expense Interest Revenue Realized Loss on Trading Securities Equity Earmings from Affiliate Companies Income Before Tax Income Tax Expense Net Income

Step by Step Answer:

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balance Sheet Changes and Cash Flow Classification Asset...View the full answer

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Students also viewed these Accounting questions

-

Using the information provided in P22-13, prepare the cash flow statement and all required disclosures for American Safety Products using the direct method. In P22-13 American Safety Products, Inc....

-

Ferragosto Services, Ltd. provided the following comparative balance sheets and income statement for the current year. Ferragosto Services, Ltd. Income Statement For the Year Ended December, 31...

-

Using the information provided in E22-12, prepare the statement of cash flows for Ferragosto Services, Ltd. under the direct method. In E22-12 Ferragosto Services, Ltd. provided the following...

-

Arvind runs a small electronics company in India and has just sold some equipment to a U.S. company for $1 million to be paid in 90 days. His cost in Indian Rupees (INR) is 60 million. The current...

-

Using Table 6.6, what is your best guess about the current price of gold per ounce? Explain with detail.

-

(a) Describe the effect of stock repurchases on income statement, balance sheet, reported EPS, ROA, and ROE (6 points) (b) Describe the difference between available-for-sale investments and trading...

-

Describe the general approach a firm of five real-estate developers might take to use the nominal group technique for deciding which property to purchase next. LO.1

-

L & M Power In the next two years, a large municipal gas company must begin constructing new gas storage facilities to accommodate the Federal Energy Regulatory Commissions Order 636 deregulating the...

-

- 4. If the allowance method of accounting for uncollectible receivables is used, what general ledger account is credited to write off a customer's account as uncollectible? a. Uncollectible Accounts...

-

The info following the questions are from the original example. Change the total fixed manufacturing overhead cost for the Milling Department in the area back to $390,000, keeping all of the other...

-

Prepare the cash flow statement and all required disclosures for Barrys Clothing Stores, Inc. from P22-11 using the direct method. In P22-11 Barrys Clothing Stores, Inc. released its annual report...

-

Repeat the requirements of P22-1 under the indirect method. In P22-1 Shark Company provided the following balance sheet and income statement for the current year. Prepare the operating activities...

-

Use Rayleigh's quotient to approximate the lowest natural frequency of a simply supported beam with a mass \(m\) at its midspan. Use \(w(x)=\sin (\pi x / L)\) as the trial function.

-

Convert the following information into: a) a semantic net b) a frame-based representation A Ford is a type of car. Bob owns two cars. Bob parks his car at home.His house is in California, which is a...

-

Visit www.pearsonglobaleditions.com/malhotra to read the video case and view the accompanying video. Marriott: Marketing Research Leads to Expanded Offerings highlights Marriotts success in using...

-

The water level in a tank is \(20 \mathrm{~m}\) above the ground. A hose is connected to the bottom of the tank, and the nozzle at the end of the hose is pointed straight up. The tank cover is...

-

A simple experiment has long been used to demonstrate how negative pressure prevents water from being spilled out of an inverted glass. A glass that is fully filled by water and covered with a thin...

-

A golf ball is hit on a level fairway. When it lands, its velocity vector has rotated through an angle of 90. What was the launch angle of the golf ball? Pyo By Dyz =0 Uso Range R x max dya

-

Consider a dynamic system whose plant transfer function and proportional controller are given (respectively) by \[\begin{aligned}G(s) & =\frac{1}{20 s} \\D(s) & =K=20\end{aligned}\] The plant is in a...

-

An item of depreciable machinery was acquired on 1 July 2009 for $120,000 by cash It is expected to have a useful life of 10 years and zero salvage value On 1 July 2012, it was decided to revalue the...

-

What is relevance?

-

Installment-Sales Computation and Entries'Periodic Inventory Mantle Inc. sells merchandise for cash and also on the installment plan. Entries to record cost of goods sold are made at the end of each...

-

Installment Repossession Entries selected transactions of TV Land Company are presented below. 1. A television set costing $540 is sold to Jack Matre on November 1, 2010, for $900. Matre makes a down...

-

Installment-Sales Computations and Schedules Saprano Company, on January 2, 2010, entered into a contract with a manufacturing company to purchase room-size air conditioners and to sell the units on...

-

Describe how the following affect the valuation of PPE. a) Cash Discounts b) Deferred Payment Contracts

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

Study smarter with the SolutionInn App