Question: Anderson Construction assembles residential homes. It uses a job-costing system with two direct cost categories (direct materials and direct labour) and one indirect cost pool

Anderson Construction assembles residential homes. It uses a job-costing system with two direct cost categories (direct materials and direct labour) and one indirect cost pool (assembly support). The allocation base for assembly support costs is direct labour-hours. In December 2012, Anderson budgets 2013 assembly support costs to be $8,000,000 and 2013 direct labour-hours to be 160,000.

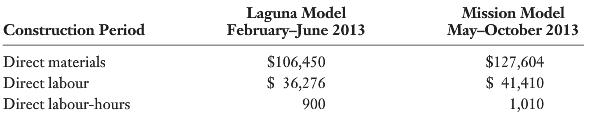

At the end of 2013, Anderson is comparing the costs of several jobs that were started and completed in 2013. Information for a couple of jobs follows.

Direct materials and direct labour are paid for on a contract basis. The costs of each are known when direct materials are used or direct labour-hours are worked. The 2013 actual assembly support costs were $6,888,000, while the actual direct labour-hours were 164,000.

REQUIRED

1. Compute the (a) budgeted and (b) actual indirect cost rate. Why do they differ?

2. What is the job cost of the Laguna Model and the Mission Model using (a) normal costing and (b) actual costing?

3. Why might Anderson Construction prefer normal costing over actual costing?

Laguna Model Mission Model May-October 2013 Construction Period Direct materials Direct labour Direct labour-hours February-June 2013 S106,450 S 36,276 $127,604 $41,410 900 1,010

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

1 Budgeted indirect cost rate Budgeted indirect costs 8000000 Budgeted direct labourhours 160000 hou... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

479-B-M-A-J-O-C (1677).docx

120 KBs Word File