Armor Security Services Inc. provides both commercial and residential security services on account. Two transactions are identified

Question:

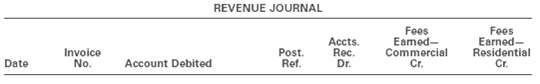

Armor Security Services Inc. provides both commercial and residential security services on account. Two transactions are identified below.Dec. 1. Issued Invoice No. 862 to Matrix Inc. for security services provided on account, $425.3. Issued Invoice No. 863 to James Lawhorn, a residential customer, for services provided on account, $85.Record these transactions in a revenue journal using the followingformat:

Transcribed Image Text:

REVENUE JOURNAL Fees Earned- Residential Cr. Fees Eamed- Accts. Post. Commercial Rec. Dr. Invoice Account Debited Date No. Cr. Ref.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 84% (19 reviews)

Dat Invoice Account No debited e Dec ...View the full answer

Answered By

Albert Kinara

i am an expert research writer having worked with various online platform for a long time. i also work as a lecturer in business in several universities and college part time and assure you well researched and articulate papers. i have written excellent academic papers for over 5 year and have an almost similar experience experting many clients in different units. bachelor of commerce (finance)

masters in strategic management

phd finance

4.60+

26+ Reviews

48+ Question Solved

Related Book For

Accounting

ISBN: 978-0324662962

23rd Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Question Posted:

Students also viewed these Accounting questions

-

Guardian Security Services Inc. provides both commercial and residential security services on account. Two transactions are identified below. Mar. 1. Issued Invoice No. 919 to Matrix Inc. for...

-

Garden Wizards provides gardening services to both commercial and residential customers. The company performs adjusting entries on a monthly basis, whereas closing entries are prepared annually at...

-

Garden Wizards provides gardening services to both commercial and residential customers. The company performs adjusting entries on a monthly basis, whereas closing entries are prepared annually at...

-

Attlee Ltd holds 28% of the issued shares of Nehru Ltd. Attlee Ltd acquired these shares on 1 July 2019 and on this date all the identifiable assets and liabilities of Nehru Ltd were recorded at...

-

A custom-made product is produced by processing materially sequentially through four departments. To process material, department #1 requires .5 hours per unit, department #2 requires .6 hours per...

-

Refer to Exercise 49. Note that X and Y are independent random variables because the two students are randomly selected from each of the campuses. Calculate and interpret the standard deviation of...

-

Describe the criterion for rejecting the null hypothesis when using the p-value method for hypothesis testing. Who chooses the value of the level of significance, ????? Make up a situation (one...

-

The following transactions occurred for London Engineering: The following transactions occurred for London Engineering: Jul 2 Paid utilities expense of $400. 5 Purchased equipment on account, $2,100....

-

Required information [The following information applies to the questions displayed below.) The following information pertains to the inventory of Parvin Company for Year 3: Jan. 1 Beginning inventory...

-

Turner Excavation maintains a checking account and has decided to open a petty cash fund. The following petty cash fund transactions occurred during July: July 2 Established a petty cash fund by...

-

The state of Ohio has a 5.5% sales tax. Buckeye Services Inc., an Ohio company, had two revenue transactions as follows:Aug. 7. Issued Invoice No. 121 to Manly Inc. for services provided on account,...

-

Using the following revenue journal for Alpha Services Inc., identify each of the posting references, indicated by a letter, as representing (1) posting to general ledger accounts or (2) posting to...

-

Do Problem 17-36 using the FIFO method of process costing. If you did Problem 17-36, explain any difference between the cost of work completed and transferred out and the cost of ending work in...

-

Using the ideas of kinetic particle theory when you come home from school and open the door you can smell food being cooked

-

The following information relates to Salamat Corporation for the last year.Salamat uses direct labor hours as an overhead base. Estimated direct labor hours 360,000 hours Estimated manufacturing...

-

Code in matlab the translational motion via numeric integration of the orbit (two-body orbit sufficient). Use the orbital characteristics of the Centaur V upper stage from the Atlas V launch on...

-

Lolita Company has the following information available for June 2020: Beginning Work in Process Inventory (25% as to conversion) 20,000 units Started 130,000 units Ending Work in Process Inventory...

-

Question 3 (15 marks) Sporty Ltd. produces scooters and skateboards. At the beginning of the year, the following volume of activities were budgeted for the year: Production volume/units Direct labour...

-

Efficient Market Hypothesis When the 56-year-old founder of Gulf & Western, Inc., died of a heart attack, the stock price immediately jumped from $18.00 a share to $20.25, a 12.5 percent increase....

-

Simplify the expression. Assume that all variables are positive. 23VI1 2 V44 8

-

Use the cereals data set for Exercises 712. Report the standard error of each imputation. Impute the potassium content of Almond Delight using multiple regression.

-

Using the data shown in Exercise 5-38, journalize the entries for the transactions assuming that Burton Company uses the perpetual inventory system.

-

Pyramid Company is a small rug retailer owned and operated by Rosemary Endecott. After the accounts have been adjusted on January 31, the following selected account balances were taken from the...

-

Buds Video Store Co. is owned an operated by Jim Budeski. The following is an except from a conversation between Jim Budeski and Ann Pavik, the chief accountant for Buds Video Store Jim; Ann, Ive got...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App