As discussed in the chapter, U.S. GAAP accounting for leases allows companies to use off???balance-sheet financing for

Question:

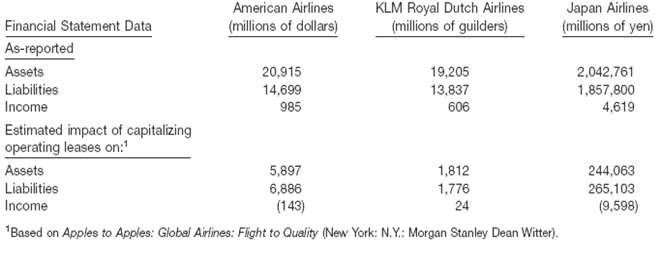

As discussed in the chapter, U.S. GAAP accounting for leases allows companies to use off???balance-sheet financing for the purchase of operating assets. International accounting standards are similar to U.S. GAAP in that under these rules, companies can keep leased assets and obligations off their balance sheets. However, under International Accounting Standard No. 17 (IAS 17), leases are capitalized based on the subjective evaluation of whether the risks and rewards of ownership are transferred in the lease. In Japan, virtually all leases are treated as operating leases. Furthermore, unlike U.S. GAAP and iGAAP, the Japanese rules do not require disclosure of future minimum lease payments. Presented below are financial data for three major airlines that lease some part of their aircraft fleet. American Airlines prepares its financial statements under U.S. GAAP and leases approximately 27% of its fleet. KLM Royal Dutch Airlines and Japan Airlines (JAL) present their statements in accordance with their home country GAAP (Netherlands and Japan, respectively). KLM leases about 22% of its aircraft, and JAL leases approximately 50% of its fleet.

(a) Using the as-reported data for each of the airlines, compute the rate of return on assets and the debt to assets ratio. Compare these companies on the basis of this analysis.

(b) Adjust the as-reported numbers of the three companies for the effects of non-capitalization of leases, and then redo the analysis in part (a).

(c) The following statement was overheard in the library: "Non-capitalization of operating leases is not that big a deal for profitability analysis based on rate of return on assets, since the operating lease payments (under operating lease accounting) are about the same as the sum of the interest and depreciation expense under capital lease treatment." Do you agree? Explain.

(d) Since the accounting for leases worldwide is similar, does your analysis above suggest there is a need for an improved accounting standard for leases? (Hint: Reflect on comparability of information about these companies' leasing activities, when leasing is more prevalent in one country than inothers.)

Depreciation is an important concept in accounting. By definition, depreciation is the wear and tear in the value of a noncurrent asset over its useful life. In simple words, depreciation is the cost of operating a noncurrent asset producing... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield