Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Best Digital, Corp., and Every Zone, Inc., and have assembled the following data.

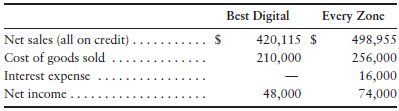

Selected income statement data for the current year:

.:.

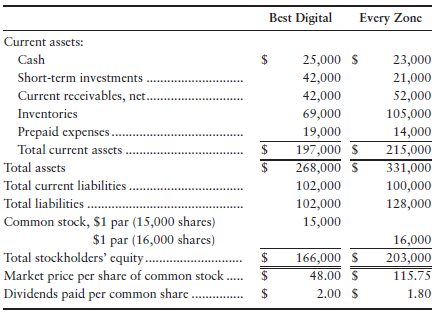

Selected balance sheet and market price data at the end of the current year:

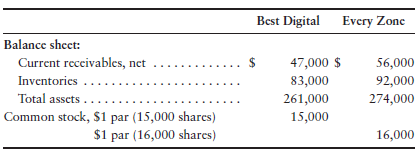

Selected balance sheet data at the beginning of the current year:

Your strategy is to invest in companies that have low price/earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis.

Requirement

1. Compute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy.

a. Acid-test ratio

b. Inventory turnover

c. Days’ sales in receivables

d. Debt ratio

e. Earnings per share of common stock

f. Price/earnings ratio

g. Dividend payout

Best Digital 420,115 $ 210,000 Every Zonc 498,955 256,000 16,000 74,000 Net sales (all on credit) . Cost of goods sold Interest expense Net income . 48,000 %24

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Req 1 Dollar Amounts and Stock Quantities in Thousands Best Digital Every Zone a Acidtest ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 1 attachment)

69-B-A-F-S (950).docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards