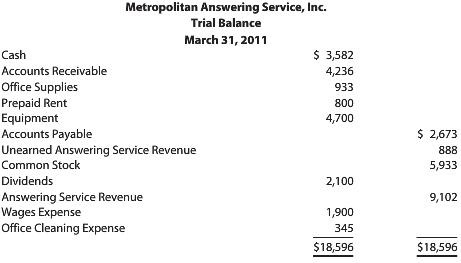

At the end of its first three months of operation, Metropolitan Answering Service, Inc., had the following

Question:

At the end of its first three months of operation, Metropolitan Answering Service, Inc., had the following trial balance.

Dan Arrow, the owner of Metropolitan Answering Service, has hired an accountant to prepare financial statements to determine how well the company is doing after three months. Upon examining the accounting records, the accountant finds the following items of interest:

a. An inventory of office supplies reveals supplies on hand of $150.

b. The Prepaid Rent account includes the rent for the first three months plus a deposit for April’s rent.

c. Depreciation on the equipment for the first three months is $416.

d. The balance of the Unearned Answering Service Revenue account represents a 12-month service contract paid in advance on February 1.

e. On March 31, accrued wages total $105.

f. Federal income taxes for the three months are estimated to be $1,110.

REQUIRED

All adjustments affect one balance sheet account and one income statement account. For each of the preceding situations, show the accounts affected, the amount of the adjustment (using a + or – to indicate an increase or a decrease, respectively), and the balance of the account after the adjustment in the following format:

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: