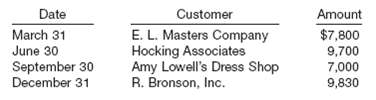

Bad-Debt Reporting the chief accountant for Dolly wood Corporation provides you with the following list of accounts

Question:

Bad-Debt Reporting the chief accountant for Dolly wood Corporation provides you with the following list of accounts receivable written off in the current year. Dolly wood Corporation follows the policy of debiting Bad Debt Expense as accounts are written off. The chief accountant maintains that this procedure is appropriate for financial statement purposes because the Internal Revenue Service will not accept other methods for recognizing bad debts. All of Dolly wood Corporation's sales are on a 30-day credit basis. Sales for the current year total $2,400,000, and research has determined that bad debt losses approximate 2% of sales.

(a) Do you agree or disagree with Dolly wood's policy concerning recognition of bad debt expense?

Why or why not?

(b) By what amount would net income differ if bad debt expense was computed using the percentage of-sales approach?

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield