Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings

Question:

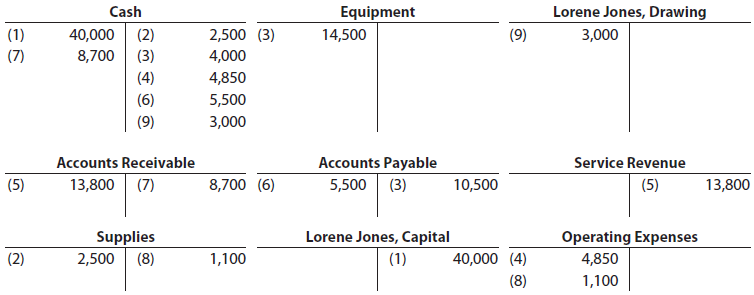

Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted.

Transcribed Image Text:

Equipment 14,500 Lorene Jones, Drawing (9) 3,000 Cash (2) 2,500 (3) (1) (7) 40,000 8,700 (3) 4,000 4,850 (4) (6) (9) 5,500 3,000 Service Revenue (5) Accounts Receivable Accounts Payable 5,500 (3) 13,800| (7) 8,700 (6) 13,800 (5) 10,500 Lorene Jones, Capital (1) Operating Expenses 4,850 Supplies (8) 2,500 (2) 40,000 (4) (8) 1,100 1,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Cash 40000 Lorene Jones Capital 40000 2 Supplies 2500 ...View the full answer

Answered By

Rukhsar Ansari

I am professional Chartered accountant and hold Master degree in commerce. Number crunching is my favorite thing. I have teaching experience of various subjects both online and offline. I am online tutor on various online platform.

5.00+

4+ Reviews

17+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-1305088436

14th edition

Authors: Carl S. Warren, Jim Reeve, Jonathan Duchac

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Accounting questions

-

Based upon the T accounts in Exercise 2, prepare the nine journal entries from which the postings were made.

-

Based upon the T accounts in Exercise 48, prepare the nine journal entries from which the postings were made.

-

Based upon the T accounts in Exercise 2, prepare the nine journal entries from which the postings were made. Discuss.

-

Chuck, a single taxpayer, earns $86,000 in taxable income and $20,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an...

-

Arthur was the father of Bridgette, Clay, and Dana and the owner of Redacre, Blackacre, and Greenacre. Arthur made and executed a warranty deed conveying Redacre to Bridgette. The deed provided that...

-

Trosper Tire Company decided to hire a new mechanic to handle all tire changes for customers ordering a new set of tires. Two mechanics applied for the job. One mechanic has limited experience, can...

-

Describe the distinctive characteristic ofweighted-average computations in assigning costs to units completed and ending work in process.

-

a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital...

-

Assume a construction contract for $400,000 to begin in 2016 and complete in 2017: 2016: Actual costs to date: $90,000 Estimated costs to complete: $210,000 Compute the amounts of revenue and gross...

-

The following information is available on the Vanier Corporation: BALANCE SHEET AS OF DECEMBER 31, 20X6 (IN THOUSANDS) INCOME STATEMENT FOR 20X6 (IN THOUSANDS) Credit sales..$8,000 Cost of goods...

-

The following accounts appeared in recent financial statements of Delta Air Lines: Accounts Payable Advanced Payments for Equipment Air Traffic Liability Aircraft Fuel (Expense) Aircraft Maintenance...

-

The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance: When the ledger and other records are reviewed, you discover the following: (1) The debits...

-

Open the Addition Solution.sln file contained in the VB2017\Chap07\Addition Solution folder. The btnNew_Click procedure is responsible for generating two random integers from 0 to 10 (including 10)...

-

Mail - Jame Mail - Jame x a Amazon.co x a Amazon.co. X https://gpt x _ Calendar - - C * gptc.blackboard.com/webapps/blackboard/content/contentWrapper.jsp?content_id=_1846554 GEORGIA PIEDMONT...

-

Prepare a partnership return and the appropriate K-1s for W & M Partnership. William Winston (SSN: 226-00-4265) lives at 53 Mantis Road, Your City, Your State - Your Zip. He operates Lovely Lady...

-

A new store is opening in Rock Spring, with 175,000 available square feet. Each department must have at least 17,000 square feet and no department can have more than 24% of the total retail floor...

-

Following is a partially completed balance sheet for Epsico Incorporated at December 31, 2022, together with comparative data for the year ended December 31, 2021. From the statement of cash flows...

-

Stockholders of Sarasota Company, Riverbed Company, and Pronghorn Company are considering alternative arrangements for a business combination. Balance sheets and the fair values of each company's...

-

Determine the domain of the function and prove that it is continuous on its domain using the Laws of Continuity and the facts quoted in this section. (x) = x 2 3x 1/2

-

Define the term utility software and give two examples.

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Difference between Operating Leverage and Financial Leverage

-

bpmn diagram for misc purchases

Study smarter with the SolutionInn App