Because of consistent losses in the past several years, Eat and Run, a fast-food franchise, is in

Question:

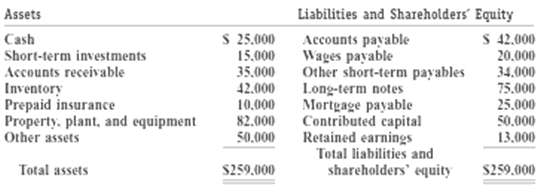

Because of consistent losses in the past several years, Eat and Run, a fast-food franchise, is in danger of bankruptcy. Its most current balance sheet follows.

Additional Information:The fair market value of the marketable securities is $19,000.The sale of the accounts receivable to a local bank would produce about @25,000 cash. A portion of the inventory originally costing $21,000 is now obsolete and can be sold for $3,000 scrap value. The remaining inventory is worth approximately $30,000.Prepaid insurance is nonrefundable.In the event of bankruptcy, the property, plant and equipment owned by Eat and Run would be divided up and sold separately. It has been estimated that these sales would bring approximately $100,000 cash.Other assets (primarily organizational costs) cannot be recovered.REQUIRED:a. The book value (balance sheet assets less liabilities) of Eat and Run is $63,000. Comment on why this balance sheet value may not a be a good indication of the value of the company in the case of bankruptcy. b. If Eat and Run goes bankrupt, what would you consider to be the value of the company?c. When a company goes bankrupt, the creditors are usually paid off first with the existing assets, and then, if assets remain, the shareholders are paid. If Eat and Run goes bankrupt, would the shareholders receive anything? If so, howmuch?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: