Question: Below is the balance sheet information on two companies. Prepare a common-size balance sheet for each company. Review each company's percentage of total assets. Are

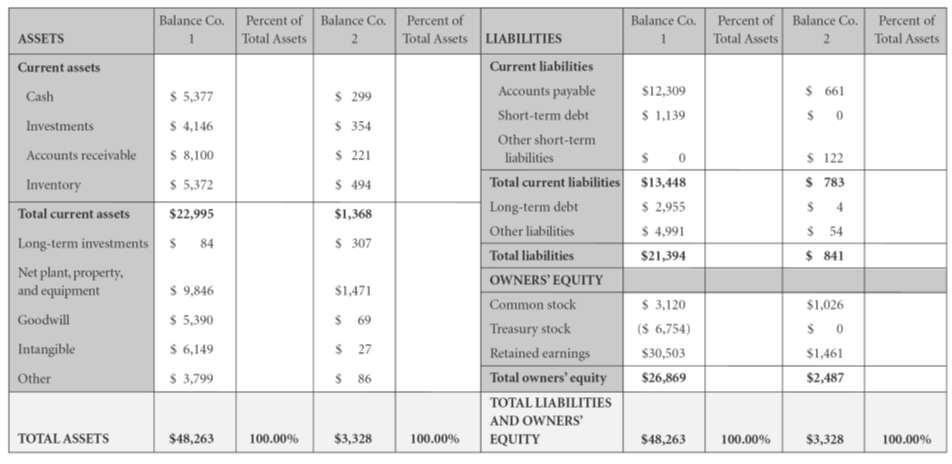

Below is the balance sheet information on two companies. Prepare a common-size balance sheet for each company. Review each company's percentage of total assets. Are these companies operating with similar philosophies or in similar industries? What appears to be the major difference in financing for these twocompanies?

Balance Co. Percent of Balance Co. Total Assets Percent of Balance Co. Percent of Total Assets Balance Co. Percent of ASSETS Total Assets LIABILITIES Total Assets Current liabilities Current assets $ 661 Accounts payable $12,309 $ 5,377 $ 299 Cash $ 1,139 Short-term debt $ 354 $ 4,146 Investments Other short-term $ 8,100 $ 221 Accounts receivable $ 122 $ 783 liabilities Total current liabilities $ 5,372 $ 494 $13,448 Inventory $ 2,955 $ 4,991 Long-term debt Total current assets $22,995 $1,368 $ 54 Other liabilities Long-term investments $ $ 307 84 $ 841 Total liabilities $21,394 Net plant, property, and equipment OWNERS EQUITY $ 9,846 $1,471 $ 3,120 $1,026 Common stock $ 5,390 $ 69 Goodwill Treasury stock ($ 6,754) $ 27 $ 6,149 Intangible Retained earnings $30,503 $1,461 $ 3,799 $ 86 Total owners' equity $26,869 $2,487 Other TOTAL LIABILITIES AND OWNERS' TOTAL ASSETS $48,263 $3,328 100.00% 100.00% EQUITY $48,263 100.00% $3,328 100.00%

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Account B Sheet Co 1 of Total Assets B Sheet Co 2 of Total Assets Current Assets Cash 5377 1114 299 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

296-B-F-F-M (2728).docx

120 KBs Word File