Below is the Retained Earnings account for the year 2012 for Acadian Corp. Instructions(a) Prepare a corrected

Question:

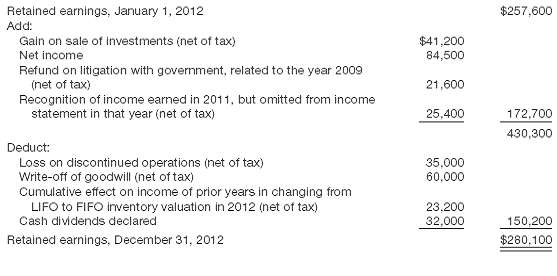

Below is the Retained Earnings account for the year 2012 for Acadian Corp.

Instructions(a) Prepare a corrected retained earnings statement. Acadian Corp. normally sells investments of the type mentioned above. FIFO inventory was used in 2012 to compute net income.(b) State where the items that do not appear in the corrected retained earnings statement should beshown.

Transcribed Image Text:

Retained earnings, January 1, 2012 $257,600 Add: Gain on sale of investments (net of tax) $41,200 84,500 Net income Refund on litigation with government, related to the year 2009 (net of tax) Recognition of income earned in 2011, but omitted from income statement in that year (net of tax) 21,600 25,400 172,700 430,300 Deduct: Loss on discontinued operations (net of tax) Write-off of goodwill (net of tax) Cumulative effect on income of prior years in changing from LIFO to FIFO inventory valuation in 2012 (net of tax) Cash dividends declared 35,000 60,000 23,200 32,000 150,200 $280,100 Retained earnings, December 31, 2012

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

a ACADIAN CORP Retained Earnings Statement For the Year Ended December 31 2012 Retained earnings ...View the full answer

Answered By

ALBANUS MUTUKU

If you are looking for exceptional academic and non-academic work feel free to consider my expertise and you will not regret. I have enough experience working in the freelancing industry hence the unmistakable quality service delivery

4.70+

178+ Reviews

335+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting questions

-

Below is the Retained Earnings account for the year 2014 for Acadian Corp. Instructions (a) Prepare a corrected retained earnings statement. Acadian Corp. normally sells investments of the type...

-

The following is the retained earnings account for the year 2019 for Acadian Corp. Instructions a. Prepare a corrected retained earnings statement. (Ignore income tax effects.) FIFO inventory was...

-

Below is the Retained Earnings account for the year 2020 for Acadian Corp. Instructions a. Prepare a corrected retained earnings statement. Acadian Corp. normally sells investments of the type...

-

Calculate the weighted average cost of capital for Genedak-Hogan for before and after international diversification. Did the reduction in debt costs reduce the firm's weighted average cost of...

-

On July 1, 2017, Givarz Corporation, a public company, purchased $300,000 of Schuett Corp. 10-year, 3% bonds at 91.8 when the market rate of interest was 4%. Interest is received semi-annually on...

-

Prove, by mathematical induction, that 3 (3n+2) + 4 is divisible by 13 for n 0.

-

Are customer complaints decreasing, increasing, or stable?

-

The cash budget and the budgeted statement of cash flows both provide information about cash. What information about cash is common to these two sources, and what information is unique to the two...

-

During the first month of operations (May 2020), Self Services Ltd. completed the following selected transactions. (Click the icon to view the transaction data.) Requirement Prepare the trial balance...

-

Hartman Inc. issues 500 shares of $10 par value common stock and 100 shares of $100 par value preferred stock for a lump sum of $100,000. Instructions (a) Prepare the journal entry for the issuance...

-

Presented below is a combined single-step income and retained earnings statement for Nerwin Company for 2012. Additional facts are as follows.1. ??Selling, general, and administrative expenses?? for...

-

Wade Corp. has 150,000 shares of common stock outstanding. In 2012, the company reports income from continuing operations before income tax of $1,210,000. Additional transactions not considered in...

-

Selected information is provided for Tiny Bubbles Bath Company: Calculate ROE from 2010 to 2012 and evaluate whether you think this company's ROE growth is sustainable. Sales Assets Net income Total...

-

1. what is the Signs of Malnutrition?

-

Example 5.1 Simply Supported Truss 8' B 2 kips Determine: a) Support reactions b) Internal force in each member Pin 5' D 4 kips 7' 6' Roller

-

Find the rank by reducing to normal form: 1 1 2 3 1 3 0 3 1 -2-3-31 1 12 3

-

A turtle can swim in a still pond at a speed of 0.76 m/s. The turtle is crossing a stream with 0.86 m/s current flowing to the East. The turtle is pointed downstream at an angle of 62 with respect to...

-

(10 pts) An aluminum "L" shaped bar (also known as "angle") and its cross-section are shown in the fol- lowing figure. Hand-calculate the centroid of the section and the moments inertia, Ir and Iy,...

-

The BAT Model Given the following information, calculate the target cash balance using the BAT model: Annual interest rate 12% Fixed order cost 100 Total cash needed 240,000 What are the opportunity...

-

Assessing simultaneous changes in CVP relationships Braun Corporation sells hammocks; variable costs are $75 each, and the hammocks are sold for $125 each. Braun incurs $240,000 of fixed operating...

-

Which would you expect to release the most hydration energy when dissolved in water: KCl(s), Mg(OH) 2( s), or CO 2 (g)? Which would you expect to release the least hydration energy? Explain your...

-

If the going concern assumption is not made in accounting, what difference does it make in the amounts shown in the financial statements for the following items? (a) Land. (b) Unamortized bond...

-

If the going concern assumption is not made in accounting, what difference does it make in the amounts shown in the financial statements for the following items? (a) Land. (b) Unamortized bond...

-

What accounting assumption, principle, or modifying convention does Target Corporation use in each of the situations below? (a) Target uses the lower of cost or market basis to value inventories. (b)...

-

The wash sale rules apply to disallow a loss on a sale of securities_______? Only when the taxpayer acquires substantially identical securities within 30 days before the sale Only when the taxpayer...

-

Assume that the one-year interest rate in the US is 4% and in the Eurozone is 6%. According to interest rate parity (IRP), What should the one-year forward premium or discount of the euro be (use of...

-

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total...

Study smarter with the SolutionInn App