Boston Celtics Limited Partnership II and Subsidiaries presented these consolidated statements of income for 1998, 1997, and

Question:

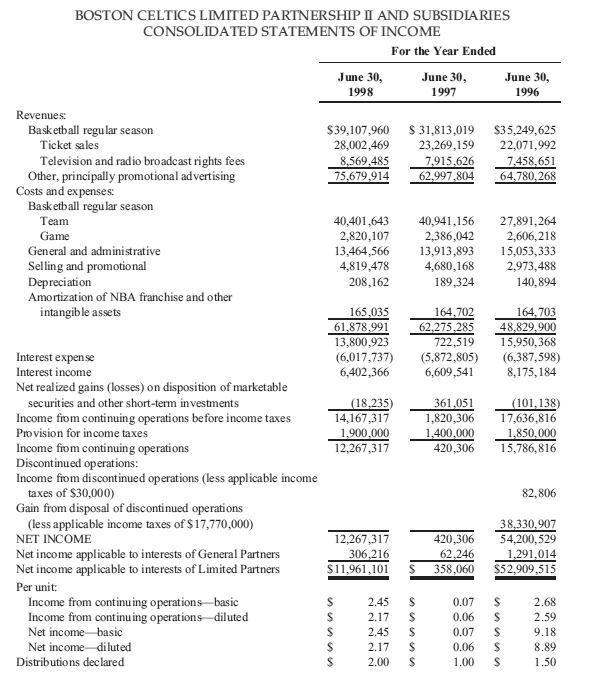

Boston Celtics Limited Partnership II and Subsidiaries presented these consolidated statements of income for 1998, 1997, and 1996.

Required

a. Comment on Amortization of NBA Franchise and Other Intangible Assets.

b. Would the discontinued operations be included in projecting the future? Comment.

c. The costs and expenses include team costs and expenses. Speculate on the major reason for the increase in this expense between 1996 and 1997.

d. What were the major reasons for the increase in income from continuing operations between 1997 and 1998?

e. Speculate on why distributions declared were higher in 1998 than 1996.

Transcribed Image Text:

BOSTON CELTICS LIMITED PARTNERSHIP Ⅱ AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME For the Year Ended June 30 1997 une une 1998 1996 Revenues: Basketball regular season S39,107,960 31,813,09 S35,249,625 28,002,469 23,269,59 22,071,992 7458,651 64,780,268 Ticket sales Television and radio broadcast rights fees Other, principally promotional ad vertising 7915.626 8.569.485 2004 62,997.804 75,679,914 Costs and expenses: Basketball regular season Team Game General and administrative Selling and promotional Depreciation Amortization of NBA franchise and other 40,401,643 40,941,156 27,891,264 2,386,042 13,464,566 3,913,893 15,053,333 4,680,168 189,324 2,820,107 2,606,218 4,819,478 208,162 2,973,488 140,894 164,703 722,519 5,950,368 8,175, 184 intangible assets 164,702 61,878,991 13,800,923 Interest expen se Interest income Net realized gains (losses) on disposition of marketable (6,017,737) 5,872,805 6,387,598) 6,609,541 6,402,366 urities and other short-term investments (18,235) 36051 101.138) sec Income fiom continuing operations before income taxes Provision for income taxes Income fiom continuing operations Discontinued operations: Income from discontinued operations (less applicable income 14,167,317 1,900,000 12,267,317 1,820,306 17,636,816 1400,000 1853640 420,30615,786,816 82,806 taxes of S30,000) Gain from disposal of discontinued operations (less applicable income taxes of $17,770,000) NET INCOME Net income applicable to interests of General Partners Net income applicable to interests of Limited Partners Per unit: 38,330,907 420,306 54,200,529 12,267,317 306,216 $11,961,101 S 358,060 $52,909.515 Income from continuing operations basic Income from continuing operations diluted Net income basic Net income diluted 2.45 S 2.17 S 2.45 S 2.17 S 2.00 S 2.68 2.59 0.06 S 0.07 S 0.06 S 1.00 S 8.89 1.50 Distributions dec lared

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (14 reviews)

a Franchise and other intangible assets were recognized as ...View the full answer

Answered By

Allan Olal

I have vast tutoring experience of more than 8 years and my primary objective as a tutor is to ensure that a student achieves their academic goals.

4.70+

78+ Reviews

412+ Question Solved

Related Book For

Financial Reporting And Analysis Using Financial Accounting Information

ISBN: 139

12th Edition

Authors: Charles H Gibson

Question Posted:

Students also viewed these Accounting questions

-

a. Comment on Amortization of NBA Franchise and Other Intangible Assets. b. Would the discontinued operations be included in projecting the future? Comment. c. The costs and expenses include team...

-

A project has estimated cash flow shown below. What is the internal rate of return? Choose the answer closest to the correct value YEAR NCE 0 1 2 3 4 5 6 7 8 9 -100,000 10,000 10,000 10,000 10,000...

-

David Companys Statements of Income for the year ended December 31, 2008, and December 31, 2007, are presented here: Additional facts are as follows: a. On January 1, 2007, David Company changed its...

-

As we continue our discussions regarding revenue's associated with public sector, this will help reinforce some of the ideas regarding taxes on goods and services. Through the next week, save your...

-

Safeway operates 1,678 supermarkets in the United States and Canada. In the United States, Safeway is located principally in the Western, Southwestern, Rocky Mountain, Midwestern, and Mid-Atlantic...

-

Journal entries under various methods of accounting for investments. Mulherin Corporation made three long-term investments on January 2. Data relating to these investments appear below. Assume that...

-

a. Identify the consumers target parameter. b. Compute a point estimate of the target parameter. c. What is the problem with using the normal (z) statistics to find a confidence interval for the...

-

Alcoa Inc. is the worlds largest producer of aluminum products. One product that Alcoa manufactures is aluminum sheet products for the aerospace industry. The entire output of the Smelting Department...

-

FINANCIAL REPORTING INDIVIDUAL ASSIGNMENT (22 MARCH 2020) Marks: [35] NB: Please use the answer sheet provided. You may use non-programmable calculators. QUESTION 1: (15 MARKS) Answer each of the...

-

JENNY'S APARTELLE Create Jenny's Apartelle 2014 from you current model of 2013. SCENARIO: Starting January 2014 the Apartelle will have the following rent and additional income: Rent: 1 Bedroom = $...

-

On October 15, 1990, United Airlines (UAL Corporation) placed the largest wide-body aircraft order in commercial aviation history60 Boeing 747-400s and 68 Boeing 777swith an estimated value of $22...

-

a. 1. Are inventories classified as a current asset? Comment. 2. Does it appear that inventories are a highly liquid asset? b. 1. Goodwill impairment'what does this imply? 2. Comment on the review of...

-

Explain why point e in Figure 10.3 is not on the contract curve? Figure 10.3 Contract Curve Denise's candy 60- - 40 80 50 Od Contract curve 30 20 20 30 50 80 40 20- Jane's candy New Allocation, f...

-

Use z scores to compare the given values. Based on sample data, newborn males have weights with a mean of 3240.3 g and a standard deviation of 675.8 g. Newborn females have weights with a mean of...

-

Compare the given pulse rates of the females and males using boxplots. Female 80 94 Male 84 74 50

-

In Exercises 29-32, compute the mean of the data summarized in the frequency distribution. Also, compare the computed means to the actual means obtained by using the original list of data values,...

-

Floyd's Bumpers has distribution centers in Lafayette, Indiana; Charlotte, North Carolina; Los Angeles, California; Dallas, Texas; and Pittsburgh, Pennsylvania. Each distribution center carries all...

-

In this assignment you are asked to open the Excel Spreadsheet for YP Enterprises (March 2019) and complete the section entitled Ratios 2019 (highlighted in yellow). This will require you to...

-

What scale is commonly used to describe the effects of earthquakes?

-

The Ranch 888 Noodle Company sells two types of dried noodles:ramen, at $6.50 per box, and chow fun, at $7.70 per box. So farthis year, the company has sold a total of 110,096 boxes ofnoodles,...

-

What are the benefits to DMOs and their members from operating membership programmes?

-

In the Fisk Company's negotiations with its employees' union on January 1, 2007, the company agreed to an amendment which substantially increased the employee benefits based on services rendered in...

-

Various pension plan information of the Kerem Company for 2007 and 2008 is as follows: Required Fill in the blanks lettered (a) through (l). All the necessary information is listed. It is not...

-

The Jay Company has had a defined benefit pension plan for several years. At the beginning of 2007 the company amended the plan; this amendment provided for increased benefits to employees based on...

-

Marigold industries had the following inventory transactions occur during 2020: 2/1/20 Purchase 51 units @ $46 cost/unit 3/14/20 purchase 98 units @ $49 cost/unit 5/1/20 purchase 68 units @ $53...

-

In this investment portfolio simulation, you and the bean counters, will invest and manage a fictitional amount of $ 1 , 0 0 0 , 0 0 0 during next three weeks. The simulation includes two fictitional...

-

Roberson Corporation uses a periodic inventory system and the retail inventory method. Accounting records provided the following information for the 2018 fiscal year: Cost Retail Beginning inventory...

Study smarter with the SolutionInn App