Brandy, a U.S. corporation, operates a manufacturing branch in Chad, which does not have an income tax

Question:

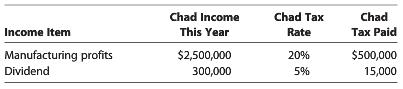

Brandy, a U.S. corporation, operates a manufacturing branch in Chad, which does not have an income tax treaty with the United States. Brandy's worldwide Federal taxable income is $30 million, so it is subject to a 35% marginal tax rate. Profits and taxes in Chad for the current year are summarized as follows.

Compute Brandy's foreign tax credit associated with its operations in Chad.

Transcribed Image Text:

Chad Income Chd Tax had Income Item This Year Tax Paid Manufacturing profits Dividend $2,500,000 300,000 Rate 20% 5% $500,000 15,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Foreign tax credit 515000 Because the local tax rates are le...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business Law questions

-

The United States has a tax treaty with the United Kingdom that provides certain tax benefits to UK corporations conducting business in the United States. The United States does not have an income...

-

A foreign subsidiary does not have an independent cost of capital.

-

In connection with the United States Bicentennial, the Treasury once contemplated offering a savings bond for $1,000 that would be worth $1 million in 100 years. Approximately what compound annual...

-

4. In St. Albert, Alberta, there are two bakers, Anderson and Carlson. Anderson's bread tastes just like Carlson's. Anderson has average costs of $1 per loaf of bread. Carlson has average costs of $2...

-

What are settlement options? Which option should you choose?

-

Organization: Sodexho Web site: www.sodexhousa.com Summary: Sodexho offers a full range of outsourcing solutions and is a leading food and facilities management services company in North America. (a)...

-

If the analysis of variance F-test leads to the conclusion that at least one of the model parameters is nonzero, can you conclude that the model is the best predictor for the dependent variable y?...

-

Do the following events represent business transactions? Explain your answer in each case. (a) A computer is purchased on account. (b) A customer returns merchandise and is given credit on account....

-

A $5000, 6.25% bond with interest payable annually redeemable at par in eight years is purchased to yield 7.5% compounded annually. Find the premium or discount and the purchase price and construct...

-

The financial statements of Tarbet Township contain the following data regarding operating results: Changes in governmental fund balances Capital outlay expenditures Debt service expenditures -...

-

Hart Enterprises, a U.S. corporation, owns 100% of OK, Ltd., an Irish corporation. OK's gross income for the year is $10 million. Determine OK's Subpart F income (before any expenses) from the...

-

Weather, Inc., a domestic corporation, operates in both Fredonia and the United States. This year, the business generated taxable income of $600,000 from foreign sources and $900,000 from U.S....

-

E-commerce has seen explosive growth in recent years. What are the most important reasons for this trend? Will it continue? Why or why not?

-

3) A spider crawls with constant speed vo on a phonograph turntable rotating with constant angular speed w in the xy plane on a radially outward path, relative to the centre of the turntable. The...

-

Question Encik Zubir ( a certified handicapped person ) is the owner of a financial consulting firm, Bijak Wealth Enterprise. The business assists its clients to grow their wealth. Encik Zubir is...

-

What is XYZ Corp.'s net cash flow XYZ Corp. (for 2020) Revenue $5,000,000 Wages: $1,000,000 D&A: $1,000,000 Property, Plant & Equipment investment: $1,500,000 Tax Rate: 35% NOWC (2020): $750,000 NOWC...

-

Tower x (m) y (m) UU3 -118.1 -15.6 OU1 -85.3 -15.9 Sensor heights (m) 3.19, 4.16, 5.04, 7.24, 9.84 1.5, 3.0, 5.46, 9.86, 15.65 OU2 -90.0 -8.3 1.5, 2.96, 5.97, 9.91, 15.08 ASU -22.8 -8.6 5.0 UUT -13.3...

-

For each of the matrices determine the value(s) of c for which the given matrix is not invertible. [4 25. 26. 3 5 } ] 6 27. 28. 2 c+4 C -8 c-6]

-

What is leverage, and what role does it play in real estate investment? How does it affect the riskreturn values of a real estate investment?

-

The National Collegiate Athletic Association (NCAA) and the National Federation of State High School Associations (NFHS) set a new standard for non-wood baseball bats. Their goal was to ensure that...

-

Hofstede found that there is a strong relationship (correlation= 0.67) between a countrys power distance score and its gross national product (GNP) per capita. In particular, he found that countries...

-

Roberta Santos, age 41, is single and lives at 120 Sanbome Avenue, Springfield, IL 60781. Her Social Security number is 123-45-6789. Roberta has been divorced from her former husband, Wayne, for...

-

Rex and Agnes Harrell purchased a beach house at Duck, North Carolina, in early 2018. Although they intended to use the beach house occasionally for recreational purposes, to help pay the mortgage...

-

Sarah was contemplating making a contribution to her traditional IRA in 2017. She determined that she would contribute $5,000 in December 2017, but forgot about making the contribution until she was...

-

Suppose Universal Forests current stock price is $59.00 and it is likely to pay a $0.57 dividend next year. Since analysts estimate Universal Forest will have a 13.8 percent growth rate, what is its...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

1. Use the Excel file Asset Allocation Data to determine the following: a.Variances for the individual assets b. Standard deviations for the individual assets c.Covariances between each pair of...

Study smarter with the SolutionInn App