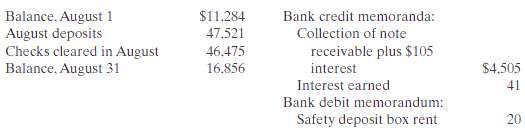

Bummer Company?s bank statement from Fifth National Bank at August 31, 2010, shows the information A summary

Question:

Bummer Company?s bank statement from Fifth National Bank at August 31, 2010, shows the information

A summary of the Cash account in the ledger for August shows: Balance, August 1, $10,959; receipts $50,050; disbursements $47,794; and balance, August 31, $13,215. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $2,600 and outstanding checks of $2,925. The deposit in transit was the first deposit recorded by the bank in August. In addition, you determine that there were two errors involving company checks drawn in August:(1) A check for $340 to a creditor on account that cleared the bank in August was journalized and posted for $430. (2) A salary check to an employee for $275 was recorded by the bank for $277.Instructions(a) Prepare a bank reconciliation at August 31.(b) Journalize the adjusting entries to be made by Bummer Company at August 31.Assume that interest on the note has not been accrued by thecompany.

Step by Step Answer:

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso