Calculate the NPV and rate of return for each of the following investments. The opportunity cost of

Question:

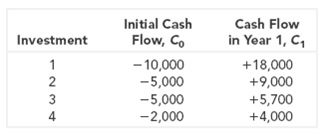

Calculate the NPV and rate of return for each of the following investments. The opportunity cost of capital is 20 percent for all four investments.

a. Which investment is most valuable?

b. Suppose each investment would require use of the same parcel of land. Therefore you can take only one. Whichone?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Initial Cash Flow, Co Cash Flow in Year 1, C, Investment - 10,000 -5,000 -5,000 -2,000 +18,000 +9,000 +5,700 +4,000 2 3

Step by Step Answer:

a Investment 1 because it has the highest NPV b Investment 1 b...View the full answer

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

You are calculating an equity required rate of return for Hewitt & Co, Inc. (NYSE: HP) using the CAPM. Rather than relying on the published beta for HP or calculating one yourself, you are going...

-

Suppose a firm estimates its required rate of return for the coming year to be 10 percent. What are reasonable required rates of return for evaluating average-risk projects, high-risk projects, and...

-

Calculate the required rate of return for Campbell Corp. common stock. The stock has a beta of 1.3 and Campbell is considered a large capitalization stock. Current long-term government bonds are...

-

Jacomo Companys output for the current period was assigned a $300,000 standard direct materials cost. The direct materials variances included a $44,000 favorable price variance and a $6,000 favorable...

-

Name two isotopes that undergo nuclear fission?

-

Find the future value of the annuity. The screen here shows how the TI-84 Plus calculator computes the future value of the annuity described in Example 9. Use a calculator with this capability to...

-

During the 2000 U.S. presidential campaign, Senator I il John McCain and Governor George W. Bush competed for the Republican nomination. Immediately prior to the South Carolina primary election,...

-

Camino Company manufactures designer to-go coffee cups. Each line of coffee cups is endorsed by a high-profile celebrity and designed with special elements selected by the celebrity. During the most...

-

On January 1, 2021, Indigo Inc.granted stock options to officers and key employees for the purchase of 24,000 shares of the company's $10 par common stock at $24 per share. The options were...

-

Terence Breezeway, the CEO of Prairie Home Stores, wondered what retirement would be like. It was almost 20 years to the day since his uncle Jacob Breezeway, Prairie Home's founder, had asked him to...

-

A parcel of land costs $500,000. For an additional $800,000 you can build a motel on the property. The land and motel should be worth $1,500,000 next year. Suppose that common stocks with the same...

-

In Section 2.1, we analyzed the possible construction of an office building on a plot of land appraised at $50,000. We concluded that this investment had a positive NPV of $7,143 at a discount rate...

-

How are social and economic risks associated with the following products likely to affect the outlet choice behavior of consumers? How would the perception of these risks differ by consumer?...

-

PART 4.1 Process Costing - Weighted Average MOLDING Physical Flow of Units Work-in-Process - Beginning Units Started this Period Units to Account for Total transferred out Work-in-Process - Ending...

-

3. A boy walks 10 m north then 3 m west. What is his total displacement? [3 marks] 4. A and B are perpendicular vectors. A = 2 and A + B a. Calculate b. Calculate A - B c. Explain your results. B bd....

-

Virginia has just been quoted what appears to be a very competitive loan for $2,000 to be paid back in 24 monthly payments of $96.66.What is Virginia's APR? What is the monthly payment for a $24,000,...

-

A four-lane urban freeway (two lanes in each direction) is located on rolling terrain and has 12-ft lanes, no lateral obstructions within 6 ft of the pavement edges, and an interchange every 2 miles....

-

In January, 1993, there were about 1,313,000 internet hosts. During the next five years, the number of hosts increased by about 100% per year. a. Write a model giving the number h (in millions) of...

-

Sales volume objectives and activity objectives serve as performance standards in evaluating the sales force. T F

-

Assessing simultaneous changes in CVP relationships Braun Corporation sells hammocks; variable costs are $75 each, and the hammocks are sold for $125 each. Braun incurs $240,000 of fixed operating...

-

Suppose that a fully charged leadacid battery contains 1.50 L of 5.00 M H 2 SO 4 . What will be the concentration of H 2 SO 4 in the battery after 2.50 A of current is drawn from the battery for 6.0...

-

The Rustic Welt Company is proposing to replace its old welt-making machinery with more modern equipment. The new equipment costs $9 million (the existing equipment has zero salvage value ). The...

-

Suppose that the expected variable costs of Otobais project are 33 billion a year and that fixed costs are zero. How does this change the degree of operating leverage? Now recomputed the operating...

-

Our Web site (www.mhhe.com/bma ) contains an Excel program for simulating the cash flows from the Otobai project. Use this program to examine which are the principal uncertainties surrounding the...

-

FINANCIAL STATEMENT ANALYSIS INSTRUCTIONS 1. PREPARE RATIO ANALYSIS REPORT ( word file) Format 1. Introduction 2. Importance of Financial Statements 3. Importance of Financial statement analysis and...

-

Let us assume that Europe is in recession, China's economy is slowing down, and the US economy is growing at 1-2%. Use these assumptions to invest in 4 ETFs (electronically traded funds). The 4 ETFs...

-

A section 83(b) election creates ordinary income at the time of the grant. Ture or False

Study smarter with the SolutionInn App