Calculating Expected Return Based on the following information, calculate the expected return: Probability of State of Economy

Question:

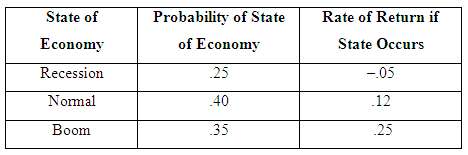

Calculating Expected Return Based on the following information, calculate the expected return:

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Transcribed Image Text:

Probability of State of Economy State of Rate of Return if Economy State Occurs 25 -05 Recession .40 .12 Nomal 35 25 Boom

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

The expected return of an asset is the su...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0077861629

8th Edition

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan

Question Posted:

Students also viewed these Corporate Finance questions

-

Calculating expected return based on the following information calculate the expected return State of Probability of State of Economy Rate of Return if Economy State Occurs Recession -09 30 70 Boom 33

-

Based on the following information, calculate the expected return and standard deviation for the twostocks. Rate of ReturnifState Occurs State of Probability of State of EconomyStockA Stock B...

-

Based on the following information, calculate the expected return and standard deviation for the twostocks. Rate of Return If State Occurs State of Economy Recession Normal Boom Probability of State...

-

Comparative figures from the statement of profit or loss of Misty Ltd are shown below: 2017 2016 Revenue (all sales) Cost of sales $450 000 292 300 $390 000 287 000 Gross profit Expenses (including...

-

At the local ski slope, an 82.0-kg skier rides a gondola to the top of the mountain. If the lift has a length of 2950 m and makes an angle of 13.1 with the horizontal, what is the change in the...

-

In this exercise, you will complete the Rectangle Area application that you created in Exercise 4 in Chapter 2. a. Use Windows to copy the Area Solution folder from the VB2017\Chap02 folder to the...

-

Discuss the application of expectancy theory to motivation.

-

Elliott Athletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm does not currently use preferred stock in its capital structure,...

-

The following information is available for Lock-Down Company, which produces special-order security products and uses a job order cost accounting system. April 30 May 31 Inventories Raw materials $...

-

Compute and interpret financial ratios that managers use to assess liquidity. Compute and interpret financial ratios that managers use for asset management purposes. Compute and interpret financial...

-

Portfolio Expected Return you have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 15 percent and Stock Y with an expected return of 10 percent. If your...

-

Calculating Returns and Standard Deviations Based on the following information, calculate the expected return and standard deviation for the two stocks: State of Rate of Return if State Occurs...

-

What other metrics would be important to measure for your company?

-

analyze the code and fix the error Main.java 2 public class Main 3- { 4 public static void main(String[] args) { 5 6 Scanner myObj-new Scanner(System.in); 7 int count = 0; // sets count to zero CO G...

-

Please provide a reflection on interimsof a C-Level Leader of a start-up technology company, how/what strategy you will consider to grow your business.

-

Using a ruler, completing the following schematics based on the information provided. 19. Draw a wiring diagram of a PSC compressor with a current start relay and a start capacitor.com 20. Draw a...

-

You observe the below command output. *?What is wrong connection timed out; no servers could be reached arya@arya:~$

-

Evaluate your strengths a supervisor and leader using the preferred leadership profile, the key performance motivators scale, the seven domains for inspiration, and other concepts from your course...

-

How does the WTO stimulate growth in international tourism? LO.1

-

The population of Detroit, Michigan, decreased from 1,027,974 in 1990 to 688,701 in 2013 (Source: U.S. Census Bureau). Find the average rate of change in the population of Detroit, Michigan, over the...

-

You are given: (i) The current price of a stock is 70. (ii) The continuously compounded risk-free interest rate is 5%. (iii) The price of a 70-strike 1-year European call option is 5. (iv) The price...

-

What are the two components of total risk?

-

Why does the total risk of a portfolio not approach zero as the number of assets in a portfolio becomes very large?

-

Why are returns on the stock market used as a benchmark in measuring systematic risk?

-

THIS IS ONE QUESTION WITH TWO PARTS. PLEASE ANSWER COMPLETELY AND SHOW ALL WORK. (NO EXCEL) Information for Question 1: State Probability Retum on A Return on B Return on C Retum on Portfolio X Boom...

-

Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (2.0 hrs. @ $13.00 per hr.) Overhead (2.0 hrs. @ $18.50 per hr.) Total standard cost $25.00 26.00 37.00 $88.00 The predetermined overhead rate...

-

Problem 1-28 (Algo) (LO 1-4, 1-5, 1-6b 1-7) Harper, Inc., acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2020, for $316,100 in cash. The book value of Kinman's...

Study smarter with the SolutionInn App