Carlson Electronics Ltd. is a Canadian-controlled private corporation that wholesales electronics equipment. The company also manufactures a

Question:

Carlson Electronics Ltd. is a Canadian-controlled private corporation that wholesales electronics equipment. The company also manufactures a small switching device and has begun a research program to improve the product.

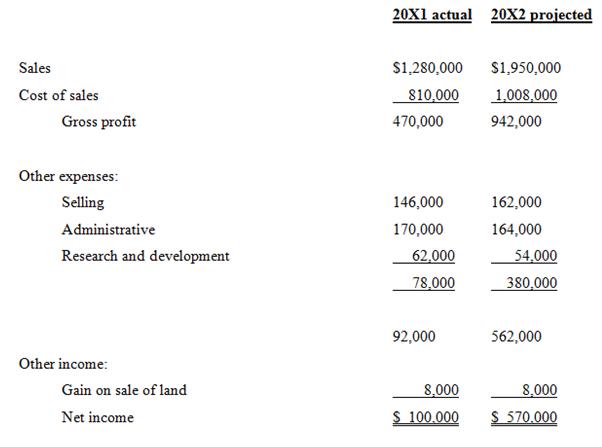

The controller has just completed the first draft of the financial statements for the year ended December 31, 20X1. A profit of $100,000 is indicated. The company has recently secured some new major customers, and next year’s profits are expected to be $570,000. The current year’s income statement and next year’s projected income statement are as in the table below.

As a Canadian-controlled private corporation, the company pays tax at an assumed rate of 15% on its first $500,000 of annual active business income and at 25% on income in excess of $500,000.

At a meeting with the company president, the controller provides the following additional information:

• As a result of improved administration and a revised credit policy, the amount of uncollectible receivables has declined. In fact, the 20X1 administrative expenses include a reserve for doubtful accounts of only $21,000; the previous year’s reserve was $70,000.

• The research and development expense of $62,000 in 20X1 includes direct costs (wages and materials) for designing and testing an improved switching device. Of these costs, 90% qualify as scientific research and experimental development costs for income tax purposes.

• In 20X1, the corporation sold a parcel of land for $216,000.The land, which is next to a proposed real estate development, was acquired the previous year for $200,000. Carlson had hoped to turn a quick profit by holding the land until a public announcement about the project was made. The selling price of $216,000 consisted of cash of $108,000, with the remaining amount of $108,000 payable (with interest) in 20X2. In accordance with the income tax provisions, the gain of $16,000 is being recognized as income over two years ($8,000 per year), and this is reflected in the financial statements.

Whenever possible, the company takes advantage of purchase discounts offered by its suppliers. Most suppliers offer a purchase discount of 2% of the merchandise cost if payment is made within 10 days; otherwise, the full purchase price is payable at the end of 30 days, with substantial interest charged thereafter. Owing to the anticipated sales volume increase for 20X2, the company’s purchases will be heavy during the early part of the new year. Carlson has a line of credit at the local bank and usually pays interest at 8% on its loans. Currently, it has used up all of its approved line of credit.

Required:

1. Based on the financial statements provided, what amount of tax will the company be required to pay in 20X1 and in 20X2?

2. What actions can be taken to reduce the amount of tax payable over the two-year period? Calculate the tax savings, if any, which can be achieved by these actions.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold