Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the

Question:

Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31.

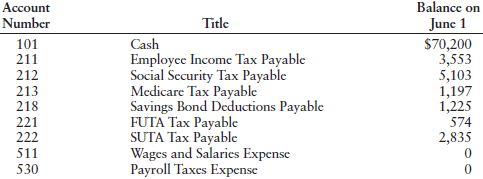

The accounts kept by Cascade include the following:

.:.

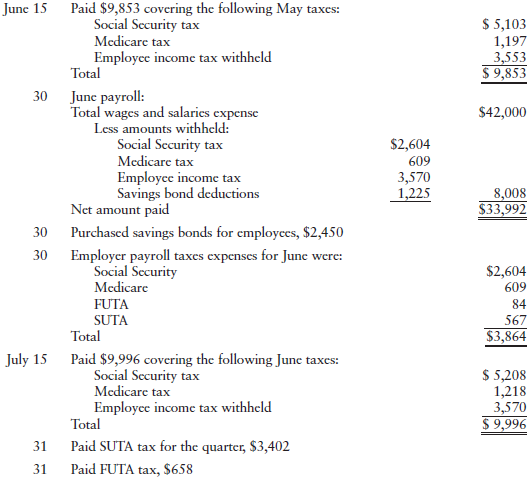

The following transactions relating to payrolls and payroll taxes occurred during June and July:

REQUIRED

1. Journalize the preceding transactions using a general journal.

2. Open T accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.

Transcribed Image Text:

Balance on Account Junc 1 Number Title Cash Employce Income Tax Payable Social Security Tax Payable Medicare Tax Payable Savings Bond Deductions Payable FUTA Tax Payable SUTA Tax Payable Wages and Salarics Expense Payroll Taxes Expense $70,200 101 211 3,553 5,103 1,197 1,225 213 218 221 574 2,835 222 511 530

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (14 reviews)

1 2 DATE DESCRIPTION GENERAL JOURNAL 2015 Employee ...View the full answer

Answered By

Albert Kinara

i am an expert research writer having worked with various online platform for a long time. i also work as a lecturer in business in several universities and college part time and assure you well researched and articulate papers. i have written excellent academic papers for over 5 year and have an almost similar experience experting many clients in different units. bachelor of commerce (finance)

masters in strategic management

phd finance

4.60+

26+ Reviews

48+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting questions

-

Oxford Company has five employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Oxford Company include the following: The following...

-

The employees of Agonnacultis, Inc., are paid on a semimonthly basis. Compute the FICA taxes for the employees for the November 15 payroll. All employees have been employed for the entire calendar...

-

The employees of Black Cat Designs are paid on a semimonthly basis. Compute the FICA taxes for the employees for the November 30, 2015, payroll. All employees have been employed for the entire...

-

Assume an employee signs a non - disparagement clause. What would be considered breaking this clause? a . ) Telling a company's trade secret to a competing firm for a fee b . ) Using a work computer...

-

In the audit of Larnet Manufacturing Pty Ltd, the auditor concluded that internal controls were inadequate because of the lack of segregation of duties. As a result, the decision was made to carry...

-

Find v (in m/s) if log v = 8.4768, where v is the speed of light.

-

Download an Excel template for this problem online in MyAccountingLab or at http://www.pearsonhighered.com/Horngren. The James Island Clothing Company began operations on July 1, 2018. The adjusted...

-

At July 31, Martinez Company has the following bank information: cash balance per bank $7,420, outstanding checks $762, deposits in transit $1,120, and a bank service charge $20. Determine the...

-

You bought one of Great White Shark Repellant Co.s 5.8 percent coupon bonds one year ago for $1,030. These bonds make annual payments and mature 14 years from now. Suppose you decide to sell your...

-

Cinnabar Company has provided the following data concerning its operations for the year ended December 31, 20A: Required Prepare the cost of goods sold statement. $24,000 30,000 70,000 14,000...

-

Selected information from the payroll register of Anderson's Dairy for the week ended July 7, 20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.8%, both on the first $7,000...

-

Willamette Manufacturing estimated that its total payroll for the coming year would be $650,000. The workers compensation insurance premium rate is 0.3%. REQUIRED 1. Calculate the estimated workers...

-

Suppose the following bond quote for IOU Corporation appears in the financial page of today's newspaper. Assume the bond has a face value of $1,000, and the current date is April 15, 2008. What is...

-

San Antonio S.A. rents a store in the Cusco Shopping Center, carrying out a series of modifications and installations in said store with the commitment that, at the end of the rental, it will...

-

b. If the above transactions covered a full year's operations, prepare a journal entry to dispose of the overhead account balance. Assume that the balance is significant. Also assume that the...

-

On 1 May 2015 Harry's Plastics Ltd acquires goods from a supplier in the US. The goods are shipped f.o.b. from the United States on 1 May 2015. The cost of the goods is US$1 500 000. The amount has...

-

In this assignment, you are going to analyze the financial viability of two companies, currently listed on the TSX . Then you will make an investment decision and justify your reasoning. Email your...

-

Create a journal entry for expense closing enteries. Time period: 3 months Entry number HBS073 This journal entry have 13 accounts Income Statement Weeks 1-10 Total Revenue Rental Revenue Sales...

-

The following data were collected during a study of consumer buying patterns: Observation x y 1 15 74 2 25 80 3 40 84 4 32 81 5 51 96 6 47 95 7 30 83 8 18 78 9 14 70 10 15 72 11 22 85 12 24 88 13 33...

-

1. True or False. Pitfalls to consider in a statistical test include nonrandom samples, small sample size, and lack of causal links. 2. Because 25 percent of the students in my morning statistics...

-

Compare Bayesian reasoning and certainty factors. Which applications are most suitable for Bayesian reasoning and which for certainty factors? Why? What is a common problem in both methods?

-

Four transactions for Farmers Market and Repair Shop that took place in November 2016 appear below, along with the general ledger accounts used by the company. INSTRUCTIONS Record the transactions in...

-

The transactions listed below took place at Brown Building Cleaning Service during September 2016. This firm cleans commercial buildings for a fee. INSTRUCTIONS Analyze and record each transaction in...

-

In June 2016, Carolyn Davis opened a photography studio that provides services to public and private schools. Her firms financial activities for the first month of operations and the chart of...

-

Metlock Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $170,000....

-

(International Finance) Computing a Currency changes = (e1 - e0 )/ e0 where e0 = old currency value e1 = new currency value (a) If the dinar devalues against the U.S. dollar by 45%, the U.S. dollar...

-

2. Fill in the time line for the Sawing Department. Use the time line to help you compute the number of equivalent units and the cost per equivalent unit in the Sawing Department for September Show...

Study smarter with the SolutionInn App