CB Ltd. is a Canadian-controlled private corporation owning a portfolio of investments including stocks, bonds, and rental

Question:

CB Ltd. is a Canadian-controlled private corporation owning a portfolio of investments including stocks, bonds, and rental properties. The financial statements for the year ended June 30, 20X1, show a profit of $104,300, summarized as follows:

Bond interest…………………………………………. $ 50,000

Taxable dividends from Canadian corporations ……… 20,000

Gain on sale of assets …………………………………… 40,000

Rental loss ……………………………………………… (5,700)

Income before income taxes……………………………. $104,300

Additional financial information is outlined below.

1. The previous year’s corporation tax return includes the following tax account balances:

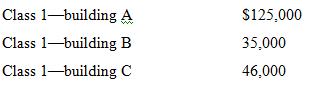

Undepreciated capital cost:

2. Taxable Canadian dividends totalling $20,000 include $8,000 from public corporations and $12,000 from X Ltd., a Canadian-controlled private corporation. CB Ltd. Owns 30% of X Ltd.’s common shares.

3. The rental properties were purchased prior to March 18, 2007. The details are as follows:

On February 28, 20Xl, property A was sold for $170,000 (land 30,000, building 40,000) and property B was sold for $77,000 (land 40,000, building 37,000). The combined rentals resulted in a loss of $5,700 after deducting amortization/depreciation of $3,000 for the year ended June 30, 20X1.The rental revenue includes a $1,000 rental deposit applying to the last two months’ rent on a lease expiring December 31, 20X2.

For the year ended June 30, 20X0, CB Ltd. deducted a reserve for unpaid rents of $2,000. In January 20X1, $1,000 of the unpaid rents was received and credited to the reserve account. No reserve has been claimed at June 30, 20X1; however, $1,200 of the current year’s rent remains unpaid.

Required:

Determine CB’s minimum net income for tax purposes for the 20X1 taxation year.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold