Cindy Tse retired in April 20X9 and moved from Thunder Bay to Vancouver Island. During her retirement

Question:

Cindy Tse retired in April 20X9 and moved from Thunder Bay to Vancouver Island. During her retirement she plans to accept the occasional small consulting contract. Her financial transactions for 20X9 are summarized below.

1. Tse sold her home in Thunder Bay for $240,000. She paid a real estate commission of $8,000 and legal fees of $2,000 to complete the sale. Tse had purchased the home in 20X3 for $110,000. In 20X6, she purchased a summer cottage for $74,000. She sold it in 20X9 for $175,000. She paid a legal fee of $1,000 to draw up the sale agreement. Tse had used the summer cottage regularly for summer vacations.

2. Tse’s gross salary from January 1, 20X9, to her date of retirement was $30,000.

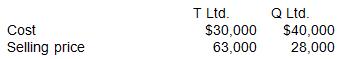

3. Three years ago, Tse purchased 20% of the shares of T Ltd. and 15% of the shares of Q Ltd. Both are Canadian-controlled private corporations. T’s assets consist entirely of investment properties, including shares, bonds, and rental properties. All of Q’s assets are used to operate an active business. Tse sold her shares in both corporations in 20X9. Details of the transactions are outlined below.

Tse received $9,000 in cash for the T Ltd. shares, with the balance payable at the rate of $9,000 annually for the next six years. The Q Ltd. shares were sold for cash.

4. A local farmer has been trying to purchase Tse’s hobby farm land. Tse purchased the land in 20X2 for $69,000. In July 20X9, Tse received $2,000 from the farmer, for which she granted him an option to purchase the land. The option is open for two years and allows the farmer to purchase the land for $100,000.

5. In February 20X9,Tse paid an investment counsellor $300 for investment advice. The same month, she purchased 5,000 units of ABC mutual fund for $10 per unit. An additional 3,000 units were purchased in April 20X9, at $14 per unit. On October 31, 20X9, ABC fund distributed $1,500 of taxable Canadian dividends, which Tse reinvested in the fund, thereby acquiring another 100 units. On December 3, 20X9, Tse sold 2,000 units of ABC at $16 per unit. At year end, the fund units were valued at $18.

6. To obtain the funds to complete the purchase of the ABC mutual fund units, Tse increased the mortgage on her house by $20,000. She incurred interest of $500 on this amount before paying off the mortgage when the house was sold.

7. In 20X8, Tse invested in a real estate project with her friend, a real estate agent and part-time developer. Together, they purchased a parcel of land and constructed four town homes at a cost of $500,000. In 20X9, the four town homes were sold for $580,000 to a single buyer, who planned to use them as rental properties. Tse’s share of the gain was 40%. No cash was invested in the project, which had been funded entirely with bank financing.

8. Tse sold shares of X Ltd. (a public corporation) for $18,000 during the year. She had acquired the shares in 20X4 for $25,000.

9. Most of Tse’s investments have been in blue-chip shares that pay dividends. Recently, she has decided to invest and trade in speculative Canadian mining shares and commodity futures. Before she does so, she wants to know the tax implications of gains and losses on such trading.

Required:

1. Calculate Tse’s minimum net income for tax purposes for the 20X9 taxation year in accordance with the aggregating formula of section 3 of the Income Tax Act.

2. Explain to Tse the potential tax consequences of gains and losses realized on trading speculative Canadian mining shares and commodity futures.

3. What will be the tax consequences to Tse if the option on the farmland is exercised the following taxation year?

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold