CJ Equity Partners is a privately held firm that buys small family- owned firms, installs professional managers

Question:

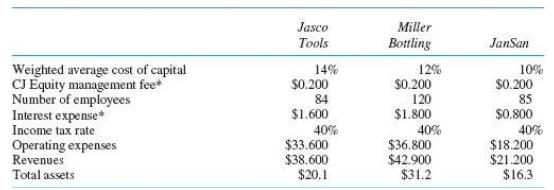

CJ Equity Partners is a privately held firm that buys small family- owned firms, installs professional managers to run the firms, and then sells them 3– 5 years later, often for a substantial profit. CJ Equity is owned by four partners who raise capital from wealthy investors and invest this money in unrelated firms. Their aim is to provide a 15 percent rate of return on their investors’ capital after paying the partners of CJ Equity a management fee. CJ Equity currently owns three operating companies: a tool and die company (Jasco Tools), a chemical bottling company ( Miller Bottling), and a janitorial supply company (JanSan). The professional managers running these three companies are paid a fixed salary and bonus based on the performance of their company. Currently, CJ Equity is measuring and rewarding its three professional managers based on the net income after taxes of their individual companies. The following table summarizes the current year’s operations of each of the three companies ( all dollar amounts in millions):

CJ Equity charges each of the three operating companies an annual management fee of $ 200,000 for managing the companies, including filing the various tax returns. The weighted average cost of capital represents CJ Equity’s estimate of the risk- adjusted, after- tax rate of return of similar companies in each operating company’s industry.

You have been hired by CJ Equity as a consultant to recommend whether CJ Equity should change the way it measures the performance of the three companies ( net income after taxes), which is then used to compute the professional managers’ bonuses.

Required:

a. Design and prepare a performance report for the three operating companies that you believe best measures each operating company’s performance and which will be used in computing the three professional managers’ bonuses. In other words, using your performance measure, compute the performance of each of the three operating companies.

b. Write a short memo explaining why you believe the performance measure you chose in part (a) best measures the performance of the three professional managers.

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman