(Comprehensive 2-Year Worksheet) Lemke Company sponsors a defined-benefit pension plan for its employees. The following data relate...

Question:

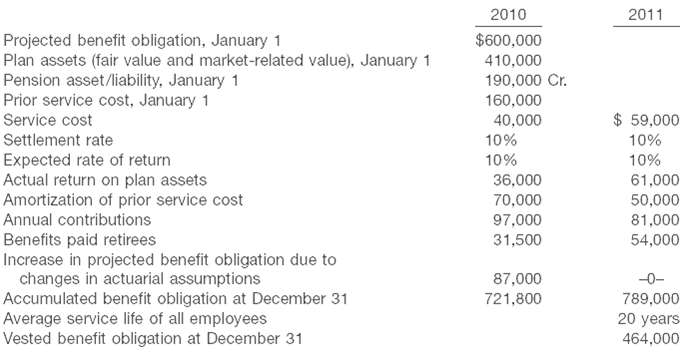

(Comprehensive 2-Year Worksheet) Lemke Company sponsors a defined-benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2010 and 2011.

(a) Prepare a pension worksheet presenting both years 2010 and 2011 and accompanying computations and amortization of the loss (2011) using the corridor approach.

(b) Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year.

(c) For 2011, indicate the pension amounts reported in the financialstatements.

Projected benefit obligation, January 1 Plan assets (fair value and market-related value), January 1 Pension asset/liability, January 1 Prior service cost, January 1 Service cost Settlement rate Expected rate of return Actual return on plan assets Amortization of prior service cost Annual contributions Benefits paid retirees Increase in projected benefit obligation due to changes in actuarial assumptions Accumulated benefit obligation at December 31 Average service life of all employees Vested benefit obligation at December 31 2010 $600,000 410,000 190,000 Cr. 160,000 40,000 10% 10% 36,000 70,000 97,000 31,500 87,000 721,800 2011 $ 59,000 10% 10% 61,000 50,000 81,000 54,000 -0- 789,000 20 years 464,000

Step by Step Answer:

a Items Balance Jan 1 2010 Service cost Interest costa Actual return Unexpected lossb Amortization of PSC Contributions Benefits Increase in PBO Journ...View the full answer

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Accounting questions

-

Lemke Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2020 and 2021. Instructions a. Prepare a pension...

-

Lemke SA sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2019 and 2020. Instructions a. Prepare a pension worksheet...

-

Glesen Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2010 and 2011. Instructions (a) Prepare a pension...

-

What does a SWOT analysis reveal about the overall attractiveness of lululemon's situation?

-

The following graph shows a market in which a price floor of $3.00 per unit has been imposed. Calculate the values of each of the following. a. The deadweight loss. b. The transfer of producer...

-

"Mauna Loa, a macadamia nut subsidiary of Hershey's with planations on the slopes of its namesake volcano in Hilo, Hawaii, exports Macadamia nuts worldwide. The Japanese market is its biggest export...

-

A foreman has determined processing times at a work center for a set of jobs and now wants to sequence them. Given the information shown, do the following: a. Determine the processing sequence using...

-

Foxx Companys cost structure is dominated by variable costs with a contribution margin ratio of .25 and fixed costs of $100,000. Every dollar of sales contributes 25 cents toward fixed costs and...

-

Do in 5 mins please Calculate Variable Overhead Variances from the following information : Budgeted Activity Actual Activity Actual Production Actual Variable Overhead Budget of Variable Overhead...

-

A rapidly growing city is dedicated to neighborhood integrity. However, increasing traffic and speed on a through street are of concern to residents. The city manager has proposed five independent...

-

(Pension Worksheet) Hanson Corp. sponsors a defined-benefit pension plan for its employees. On January 1, 2010, the following balances related to this plan. Plan assets (market-related value)...

-

(Comprehensive 2-Year Worksheet) Hobbs Co. has the following defined-benefit pension plan balances on January 1, 2010. Projected benefit obligation? ? ? ? ? ? ? ? ? ? ? ? ? ??$4,600,000 Fair value of...

-

A garage sells three types of tires, type A, type B. and type C. A customer purchases type A with probability 0.23, type B with probability 0.48. and type C with probability 0.29. a. What is the...

-

Micro-Brush requires a new component for their laptop cleaning machines. The company must decide whether to make or buy them. If it decides to make them. Should it use process A or process B? Use a...

-

Moving from a fee-for-service to a managed care delivery system set up a series of expectations (page 421). How many of these expectations are realistic? How many have been realized?

-

2. A 55 kg human is shot out the end of a cannon with a speed of 18 m/s at an angle of 60. Ignore friction and solve this problem with energy conservation. As he exits the cannon, find: a. horizontal...

-

Theoretical Background: Information Assurance (IA) architecture also known as security architecture is about planning, integrating and continually monitoring the resources of an organization so they...

-

AZCN recommends Microsoft Lens or Adobe Scan; download one of these to yo phone via your phone's app store 2. Place the document you want to scan on a flat, well-lit surface. Make sure the document...

-

On May 1, 2013, a two-year insurance policy was purchased for $24,000 with coverage to begin immediately. What is the amount of insurance expense that appears on the companys income statement for the...

-

Use the information given about the angles and to find the exact value of: (a) sin( + ) (b) cos( + ) (c) sin( - ) (d) tan ( + ) (e) sin(2) (f) cos (2) (g) sin /2 (h) cos/2 cos = 4/5, 0 < < /2; cos =...

-

Air (1 atm and 30C) flows crosswise over a bare copper tube (1-in, BWG 16). The approach velocity of the air is 20 m/s. Water enters the tube at 140C and leaves the tube at an average temperature of...

-

Francis Corporation purchased an asset at a cost of $50,000 on March 1, 2014. The asset has a useful life of 8 years and a salvage value of $4,000. For tax purposes, the MACRS class life is 5 years....

-

Judds Company purchased a new plant asset on April 1, 2014, at a cost of $711,000. It was estimated to have a service life of 20 years and a salvage value of $60,000. Judds accounting period is the...

-

Jon Seceda Furnace Corp. purchased machinery for $315,000 on May 1, 2014. It is estimated that it will have a useful life of 10 years, salvage value of $15,000, production of 240,000 units, and...

-

Marigold industries had the following inventory transactions occur during 2020: 2/1/20 Purchase 51 units @ $46 cost/unit 3/14/20 purchase 98 units @ $49 cost/unit 5/1/20 purchase 68 units @ $53...

-

In this investment portfolio simulation, you and the bean counters, will invest and manage a fictitional amount of $ 1 , 0 0 0 , 0 0 0 during next three weeks. The simulation includes two fictitional...

-

Roberson Corporation uses a periodic inventory system and the retail inventory method. Accounting records provided the following information for the 2018 fiscal year: Cost Retail Beginning inventory...

Study smarter with the SolutionInn App