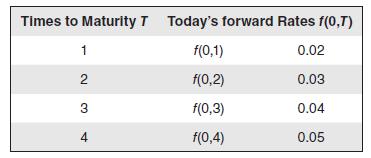

Compute the zero-coupon bond prices from the following forward rates. Times to Maturity T Today's forward Rates

Question:

Compute the zero-coupon bond prices from the following forward rates.

Transcribed Image Text:

Times to Maturity T Today's forward Rates f(O,T) f(0,2) f(0,3) f(0,4) 0.02 0.03 0.04 0.05 3 4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 61% (13 reviews)

Use the formula 1 1 f001 ...View the full answer

Answered By

Jonas Araujo

I have recently received the degree of PhD. In Physics by the Universidade Federal do Maranhão after spending a term in Durham University, as I have been awarded a scholarship from a Brazilian mobility program. During my PhD. I have performed research mainly in Theoretical Physics and published works in distinguished Journals (check my ORCID: https://orcid.org/0000-0002-4324-1184).

During my BSc. I have been awarded a scholarship to study for a year in the University of Evansville, where I have worked in detection-analysis of photon correlations in the the Photonics Laboratory. There I was a tutor in Electromagnetism, Classical Mechanics and Calculus for most of that year (2012).

I am very dedicated, honest and a fast learner, but most of all, I value a job well done.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

An Introduction to Derivative Securities Financial Markets and Risk Management

ISBN: 978-0393913071

1st edition

Authors: Robert A. Jarrow, Arkadev Chatterjee

Question Posted:

Students also viewed these Banking questions

-

Suppose you observe the following 1-year implied forward rates: 0.050000 (1 year), 0.034061 (2-year), 0.036012 (3-year), 0.024092 (4-year), 0.001470 (5-year). For each maturity year compute the...

-

Suppose you observe the following 1-year implied forward rates: 0.050000 (1 year), 0.034061 (2-year), 0.036012 (3-year), 0.024092 (4-year), 0.001470 (5-year). For each maturity year compute the...

-

Compute the forward rates for the following zero-coupon bond prices. Times to Maturity T Today's Zero-Coupon Bond Prices B(O,T) 2 3 4 B(0,2) B(0,3) B(0,4) 0.98 0.96 0.94 0.90

-

1. You are required to compare the results of your printed reports and the results of reports of the MYOB assignment book in your MYOB assignment. If it is assumed that two results of the reports are...

-

Use the distributions from Exercise 1 to answer the following questions. a. What is the probability that an individual student will be taller than 180 centimetres? b. Suppose a random sample of 25...

-

Jacobson Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2012. The bonds pay interest twice a year. Instructions (a) (1) Prepare the journal entry to record the issuance of the bonds....

-

Does a mutual fund spread or hedge risk? Explain.

-

Leno Company makes swimsuits and sells these suits directly to retailers. Although Leno has a variety of suits, it does not make the All-Body suit used by highly skilled swimmers. The market research...

-

Current cash debt coverage what ratio is it

-

The accounting firm of Coopers & Andersen is conducting a benchmarking survey to assess the satisfaction level of its clients versus clients served by competing accounting firms. The clients are...

-

Using a payoff table similar to Table 21.4 in the text, explain the portfolio of zero-coupon bonds that generates the forward rate f(0,3).

-

What is the spot rate of interest R(t)? Explain how it relates to forward rates and yields.

-

A corporation with both preferred stock and common stock outstanding has a substantial credit balance in its retained earnings account at the beginning of the current fiscal year. Although net income...

-

SOUTHWEST AIRLINES: PROFILE OF A LEADER Airlines have faced economic difficulties with rising fuel costs and increased security standards. While many airlines have faced bankruptcy and corpo- rate...

-

a-1.If the required return is 11 percent, what is the profitability index for both projects? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project...

-

More info Mar. 1, 2024 Dec. 1, 2024 Dec. 31, 2024 Dec. 31, 2024 Jan. 1, 2025 Feb. 1, 2025 Mar. 1, 2025 Mar. 1, 2025 Borrowed $585,000 from Bartow Bank. The nine-year, 5% note requires payments due...

-

Describe the Leader(s) - Leadership Qualities/Style of Captain America in the movie The Avengers 1 (2012) Describe the actions that illustrate specific leadership characteristics and behaviors of...

-

During the current year, a company exchanged old equipment costing $ 6 4 , 0 0 0 with accumulated depreciation of $ 5 0 , 0 0 0 for a new truck. The new truck had a cash price of $ 8 0 , 0 0 0 and...

-

The textbook describes three checkpoints for measuring feasibility. a. What are these checkpoints? b. Typically, how accurately can feasibility be determined at each checkpoint? c. Which checkpoint,...

-

In Exercises 516, find the focus and directrix of the parabola with the given equation. Then graph the parabola. y 2 = 4x

-

The Willowbrook Community Bank recently decided to adopt a balanced scorecard system of performance evaluation. Below is a list of primary performance goals for four major performance categories that...

-

Bridgewater Savings Association maintains a clearing account at the Federal Reserve Bank and agrees to keep a minimum balance of $30 million in its clearing account. Over the two-week reserve...

-

What are the major types of deposit plans that depository institutions offer today?

-

How has the composition of deposits changed in recent years?

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App