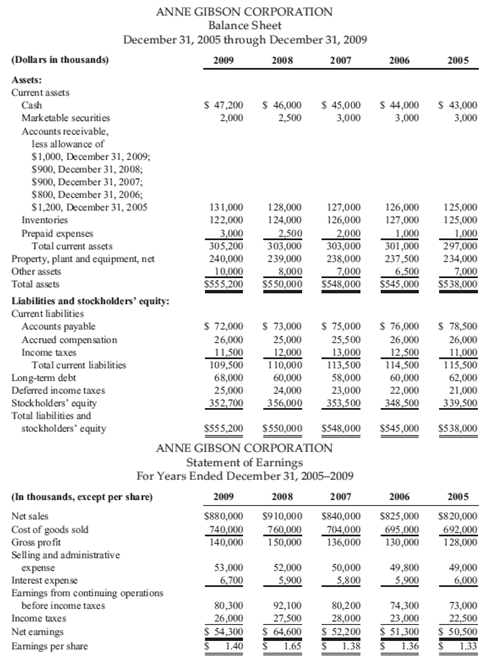

Consecutive five-year balance sheets and income statements of Anne Gibson Corporation follow: Required a. Using year-end balance

Question:

Consecutive five-year balance sheets and income statements of Anne Gibson Corporation follow:

Required

a. Using year-end balance sheet figures, compute the following for the maximum number of years, based on the available data:

1. Days' sales in receivables

2. Accounts receivable turnover

3. Accounts receivable turnover in days

4. Days' sales in inventory

5. Inventory turnover

6. Inventory turnover in days

7. Operating cycle

8. Working capital

9. Current ratio

10. Acid-test ratio

11. Cash ratio

12. Sales to working capital

b. Using average balance sheet figures, as suggested in the chapter, compute the following for the maximum number of years, based on the available data:

1. Days' sales in receivables

2. Accounts receivable turnover

3. Accounts receivable turnover in days

4. Days' sales in inventory

5. Inventory turnover

6. Inventory turnover in days

7. Operating cycle

8. Working capital

9. Current ratio

10. Acid-test ratio

11. Cash ratio

12. Sales to working capital

c. Comment on trends indicated in short-term liquidity.

(CMAA dapted)

ANNE GIBSON CORPORATION Balance Sheet December 31, 2005 through December 31, 2009 (Dollars in thousands) Assets: Current assets 2009 2008 2007 2006 2005 47,200 46,000 S 45,000 S 44,00043,000 3,000 Marketable securities Accounts receivable, 2,000 2,500 3,000 less allowance of $1,000, December 31, 2009; $900, December 31,2008 $900, December 31, 2007; $800, December 31, 2006; $1,200, December 31, 2005 Inventories Prepaid expenses 131,000 128,000 127,000 126,000 125,000 122,000 124,000 126,000 127,000 125,000 3.000 305,200 303,000 303,000 301,000 297,000 240,000 239,000 238,000 237,500 234,000 7.000 S555,200 $550,000 $548,000 S545,000 S538,000 Total current assets Property, plant and equipment, net 8,00074000 Other assets Total assets Liabilities and stockholders' equity: 10,000 Current liabilities Accounts payable Accrued compensation Income taxes 72,000 26,000 73,000 S 75,000 25,000 76,000 S 78,500 26,000 11,000 4.500 115,500 26,000 Total current liabilities 109.500 110,000 113,500 11 58,000 23,000 Long-term debt Deferred income taxes Stockholders' equity Total liabilities and 68 25,000 60,000 24,000 35,000 21,000 348.500 339.300 stockholders' equity $555,200 S550,000 S548,000 $545,000 $538,000 ANNE GIBSON CORPORATION Statement of Earnings For Years Ended December 31, 2005-2009 (In thousands, except per share) 2008 2007 2005 $880,000 $910,000 $840,000 $825,000 $820,000 Cost of goods sold Gross profit Selling and administrative 000 760,000 140,000 150,000 704.000 695000 6 136,000 130,000 128,000 53,000 6,700 52,000 5.900 49,800 5,900 49,000 6,000 ex Interest expense Earnings from continuing operations 74,300 23,000 S 54300 64,600 S52,200 S 51300 S 1.40 S1.65 1.38 36 80,300 26,000 80,200 28,000 73,000 22,500 50,500 1.33 before income taxes taxes 27,500 Net earnings Earnings per share

Step by Step Answer:

a 1 Days Sales in Receivables Gross Receivables Net Sales365 2009 131000 1000 5475 days 880000365 2008 128000 900 5170 days 910000365 2007 127000 900 5558 days 840000365 2006 126000 800 5610 days 8250...View the full answer

Financial Reporting And Analysis Using Financial Accounting Information

ISBN: 139

12th Edition

Authors: Charles H Gibson

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Accounting questions

-

Consecutive five-year balance sheets and income statements of Laura Gibson Corporation are shown below. Operating lease payments were as follows: 2009, $30,000; 2008, $27,000; 2007, $28,500; 2006,...

-

Consecutive five-year balance sheets and income statements of Mary Lou Szabo Corporation are as follows: Required a. Compute the following for the years ended December 31, 20052009: 1. Net profit...

-

Consecutive five-year balance sheets and income statements of Donna Szabo Corporation are shown below and on the following page. Required a. Compute or determine the following for the years 20052009:...

-

Uniform current sheets are located in free space as follows: 8a z A/m at y = 0, 4a z A/m at y = 1, and 4a z A/m at y = 1. Find the vector force per meter length exerted on a current filament carrying...

-

Create process specifications for process 1.4, CREATE SOFTWARE LOG FILE. Use the data flow diagram examples to determine inputs and outputs. Process details are as follows: Format the SOFTWARE LOG...

-

What is a royalty fee? Appendix

-

The partially complete ANOVA table given next is for a two-factor factorial experiment. Source df SS MS F Treatments 14 30 A 4

-

Multiple Choice Questions 1. Which of the following items should be classified under the heading of cash on the balance sheet? Postdated checks Certificates of deposit a. Yes ...... Yes b. Yes .........

-

Compute the NPV statistic for Project Y if the appropriate cost of capital is 11 percent. (Ne minus sign. Do not round intermediate calculations and round your final answer to 20 Project Y Time: Cash...

-

The acceleration ac 5 m/s2 is in the direction shown. From the velocity analysis, it was found that the angular velocity of members AB and BC are respectively @AB= 15 rad/s and @BC = 25 rad/s....

-

Multiple-Choice questions: a. A companys current ratio is 2.2 to 1 and quick (acid-test) ratio is 1.0 to 1 at the beginning of the year. At the end of the year, the company has a current ratio of 2.5...

-

Allowance for Uncollectible Accounts'Ethics vs. Conservatism To aid in determining the balance for the allowance for uncollectible accounts, an aging schedule is often prepared. The Arrow Company...

-

On a thin bar of negligible mass \(1 \mathrm{~m}\) long are arranged 5 bodies each of mass \(0.10 \mathrm{~kg}\) at distances of \(25 \mathrm{~cm}\) from each other starting from one end. Determine...

-

How do cognitive biases such as confirmation bias, anchoring, and the availability heuristic influence the quality of decision-making within complex organizational contexts ?

-

What role do cognitive biases, such as confirmation bias and anchoring, play in perpetuating conflict, and how can awareness of these biases facilitate more effective conflict resolution strategies?

-

Were you surprised by the results? Do you agree with the results? How can you use this knowledge of your personal biases to inform your management strategies? How can the identified biases impact...

-

what ways do existing power structures perpetuate social stratification, and what are the socio-political ramifications of these dynamics ?

-

How do feedback loops and reflective practices contribute to continuous improvement and the refinement of teamwork dynamics over time ? Explain

-

What percentage of all disaster-related injuries and deaths are sustained in countries with per-capita income levels below $760 per year?

-

Use integration by parts to evaluate the following. Check your answer by taking the derivative. x2e-xdx

-

What are the key drivers that todays marketer has to understand in planning for the international marketplace?

-

Backenstos Company has two different product lines and makes significant sales in both the United States and Mexico. Backenstos has compiled the following information: Required: a. Assume that...

-

King Follett Foods produces premium tofu for the U.S. market. Sales are growing rapidly in the health-conscious United States, and King Follett expects sales in 2009 to be 30% more than sales in...

-

One of the most difficult estimation questions in accounting is when contingent liabilities need to be recognized in a companys financial statements. The FASB indicated in Statement No. 5 that a...

-

Problem 1 7 - 1 2 ( Algo ) Determine pension expense; journal entries; two years [ L 0 1 7 - 3 , 1 7 - 4 , 1 7 - 5 , 1 7 - 6 , 1 7 - 7 , 1 7 - 8 The Kollar Company has a defined benefit pension plan....

-

Jen bought 100 shares of ABC stock at $15 a share on July 14, 2017. On August 7, 2018, she noticed that the stock had increased in value to $20 a share and decided to sell her shares. Jen's marginal...

-

Alex. Inci, buys 40 petcent of Steinbart Company on January 1, 2020, for $1.212.000. The equity method of accounting is to be used. Steinbart's net assets on that datewere $2.90 million. Any excess...

Study smarter with the SolutionInn App