Delannas, a privately owned, high-end womens clothing store, has been successful since it was opened five years

Question:

Delanna’s, a privately owned, high-end women’s clothing store, has been successful since it was opened five years ago. The owner, Delanna Ricci, wants to open a second store in a nearby city. She has talked with her banker about a possible loan to cover the costs for opening the store. The banker wants Delanna to submit a business plan, including estimated income statements for the first three years for both stores. Delanna already has a line of credit agreement with the bank. During part of each year, she borrows money to finance inventory purchases. She has always paid the loans off by late December, which is the store’s busiest time of year.

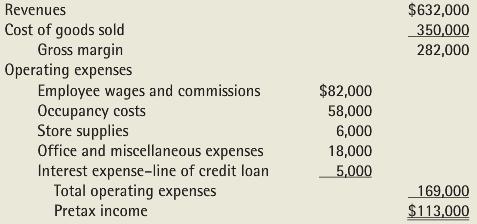

Last year’s income statement for the existing store was as follows. The business is a sole proprietorship, so it does not include a salary expense for Delanna, who manages the store.

REQUIRED

Delanna has contacted her CPA firm to help her create estimated income statements that will be submitted to the bank. You have performed quarterly compilations of Delanna’s financial statements, which are submitted to the bank under the line of credit agreement. Thus, you are assigned the job of helping Delanna develop financial statements for the new bank loan.

You have never before helped a client develop estimated financial statements, but you find the following definitions in one of your old textbooks:

Financial Forecast: Prospective financial statements that present expected results based on assumptions about conditions expected to exist and the course of action the entity expects to take. Financial Projection: Prospective financial statements that present expected results, given one or more hypothetical courses of action. Conduct research into financial accounting and attestation standards, as needed, to answer the following questions.

A. Will Delanna’s estimated income statements be considered financial forecasts or financial projections? Explain.

B. What alternative types of attestation services can a CPA perform for prospective financial statements? Briefly describe the CPA’s responsibilities for each type of attestation service.

C. Suppose Delanna has engaged your firm to perform a compilation.

1. Discuss how you would use the prior year’s income statement to help you prepare estimated future income statements for the two stores.

2. The preparation of prospective financial statements requires a set of assumptions, similar to the assumptions needed when preparing a budget. Create a list of assumptions that will be needed to create the estimated income statements.

3. Create a list of questions to ask Delanna as you gather information to create the estimated income statements.

D. Explain why Delanna is likely to be biased when she provides you with information for the estimated financial statements. Discuss whether you would be able to detect bias as you compile the estimated financial statements.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Cost Management Measuring Monitoring And Motivating Performance

ISBN: 392

2nd Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott