Drake Limousine Service is considering acquisition of an additional vehicle. The model under consideration will cost $160,000

Question:

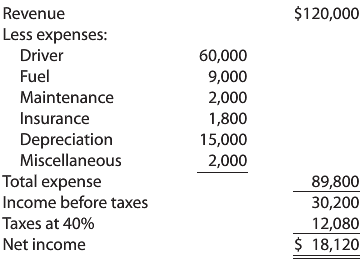

Drake Limousine Service is considering acquisition of an additional vehicle. The model under consideration will cost $160,000 and have a five-year life and a $45,000 residual value. The company anticipates that the effect on annual net income will be as follows:

Required

Calculate the net present value of the investment assuming the company has a required rate of return of 14 percent. Should the company invest in the new limousine?

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: