DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed

Question:

DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be $130,000. The firm has a chance to sell its 4-year-old roaster for $35,000. The existing roaster originally cost $60,000 and was being depreciated using MACRS and a 7-year recovery period.

DuPree is subject to a 40% tax rate.

a. What is the book value of the existing roaster?

b. Calculate the after-tax proceeds of the sale of the existing roaster.

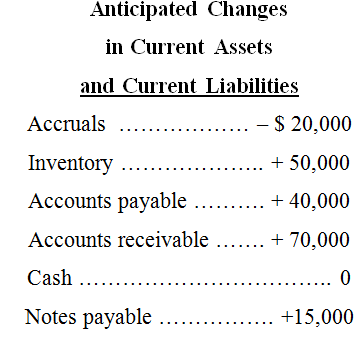

c. Calculate the change in net working capital using the following figures:

d. Calculate the initial investment associated with the proposed new roaster.

.png)

Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes TABLE 4.2 Percentage by recovery yea ycars 20% 32 19 12 12 10 ycars 10% 18 14 12 Recovcry ycar 3 ycars 33% 45 15 14% 25 18 12 4 10 100% 100% 100% 100% Totals "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance depreciation using the half-year convention

Step by Step Answer:

a Book value 60000 031 18600 b Sales price of old equipment 35000 Book value of old equipment 18600 ...View the full answer

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Finance questions

-

What was the change in net working capital during the year?

-

What does an increase in net working capital mean with regard to cash flow?

-

The installed cost of a new computerized controller was $65,000. Calculate the depreciation schedule by year assuming a recovery period of 5 years and using the appropriate MACRS depreciation...

-

For five years, Chaple, an accountant licensed by the state of Georgia, provided accounting services to Roberts and several corporations in which Roberts was an officer and shareholder (collectively...

-

Identify whether each of the following is most likely (a) A debt or equity investment, and (b) A non-strategic or strategic investment. (c) Identify the most likely reason (such as earning gains,...

-

What is the oxidation state of iron in goethite?

-

The accounting firm of Price Waterhouse annually monitors the U.S. Postal Service's performance. One parameter of interest is the percentage of mail delivered on time. In a sample of 332,000 items...

-

Based on the information below, record the adjusting journal entries that must be made for Sufen Consulting on June 30, 2019. The company has a June 30 fiscal year-end. Use 18 as the page number for...

-

Chapter 8 question 2 Please answer graph and fill in the blanks Based on your answers from the previous question, and assuming that the marginal revenue curve is a straight line, use the black line...

-

Gven, Elaimis, Binokay, and Tan (2003) studied the distribution of paw preferences in rats using a computerized food-reaching test. For a sample of n = 144 rats, they found 104 right-handed animals....

-

Edwards Manufacturing Company (EMC) is considering replacing one machine with another. The old machine was purchased 3 years ago for an installed cost of $10,000. The firm is depreciating the machine...

-

A firm is evaluating the acquisition of an asset that costs $64,000 and requires $4,000 in installation costs. If the firm depreciates the asset under MACRS, using a 5-year recovery period, determine...

-

Marshall, Brendan and Nick are partners and sharing profits or losses in the ratio of 2:1:1 respectively. On 31 July 2009, they agree to dissolve the partnership. Their balance sheet as at 31 July...

-

Brian is considering increasing the length of the cryptographic keys used by his organization. If he adds 8 bits to the encryption key, how many more possible keys will be added to the key space for...

-

Business law SECHON A [100 Marks] Read the scenario below then answer the questions that follow. Contracts are of critical importance especially in daily commercial and business transactions....

-

You may assume that the production costs to the winery are the same for each of the possible wines, despite the differences in volumes with some of the possible wines. Thus maximizing revenue will be...

-

You encounter a split system that uses R-22 refrigerant and observe the following refrigeration parameters from the unit's control display. The unit is operating in cooling mode. Suction pressure:...

-

A refrigerant at -20C is flowing through a 4" schedule 40 carbon steel pipe (inner diameter 102 mm, outer diameter 114 mm); the heat transfer coefficient for the refrigerant is 2500 W/m/K. It is...

-

Discuss the advantages and disadvantages of a master estimate (as described herein) as it relates to an estimating program.

-

The swap spread is the difference between the swap rate and the equivalent-maturity Treasury bond yield. Explain why a widening swap spread may be a signal of deteriorating economic conditions. Plot...

-

What has been the most commonly used building stone throughout history, and why?

-

Levin Corporation has fixed operating costs of $72,000, variable operating costs of $6.75 per unit, and a selling price of $9.75 per unit. a. Calculate the operating breakeven point in units. b....

-

Southland Industries has $60,000 of 16% (annual interest) bonds outstanding, 1,500 shares of preferred stock paying an annual dividend of $5 per share, and 4,000 shares of common stock outstanding....

-

Northwestern Savings and Loan has a current capital structure consisting of $250,000 of 16% (annual interest) debt and 2,000 shares of common stock. The firm pays taxes at the rate of 40%. a. Using...

-

Discuss why it is important for company managers to understand and use social capital knowledge to help build social ties among their skilled knowledge workers so they can build employee loyalty...

-

Kate lives in a house close to a local university, and she traditionally has rented a garage apartment in the back of her property to students for $750 per month. Kate wants to transfer the title to...

-

Pottery Ranch Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at...

Study smarter with the SolutionInn App