Question: Equity Multiplier and Return on Equity Bettles Fried Chicken Company has a debt-equity ratio of 0.80. Return on assets is 9.2 percent, and total equity

Equity Multiplier and Return on Equity Bettles Fried Chicken Company has a debt-equity ratio of 0.80. Return on assets is 9.2 percent, and total equity is $520,000. What is the equity multiplier? Return on equity net income?

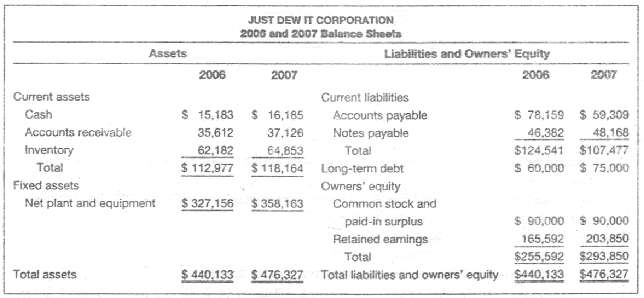

JUST DEW IT CORPORATION 2006 and 2007 Balance Sheeta Assets Liabilities and Owners' Equity 2006 2007 2007 2006 Current assets Current liabilities $ 15,183 $ 16,185 $ 78.159 $ 59,309 Cash Accounts payable Accounts receivable 35,612 37.126 Notes payable 46,382 48,168 $107,477 Inventory 62,182 $ 112.977 $124.541 64,853 $ 118,164 Total Total $ 60,000 $ 75.000 Long-term debt Fixed assets Owners' equity $ 327,156 $ 358,163 Net plant and equipment Common stock and $ 90.000 $ 90,000 paid-in surplus Retained eamings 165,592 203,850 $293,850 $255,592 Total $ 440,133 $ 476,327 Total liabilities and owners' equity $440,133 $476,327 Total assets

Step by Step Solution

3.42 Rating (174 Votes )

There are 3 Steps involved in it

The commonsize balance sheet answers are found by dividing each category by total assets For example ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-F-S (24).docx

120 KBs Word File