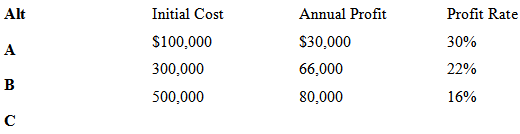

Question: A firm must decide which of three alternatives to adopt to expand its capacity. The firm wishes a minimum annual profit of 20% of the

A firm must decide which of three alternatives to adopt to expand its capacity. The firm wishes a minimum annual profit of 20% of the initial cost of each separable increment of investment.. Any money not invested in capacity expansion can be invested elsewhere for an annual yield of 20% of initial cost.

Which alternative should be selected? Use a rate of return analysis.

Initial Cost Annual Profit $30,000 Profit Rate Alt $100,000 300,000 30% 66,000 22% 500,000 80,000 16%

Step by Step Solution

3.30 Rating (176 Votes )

There are 3 Steps involved in it

Since the firm requires a 20 profit on each increment of investment one should examine th... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (211).docx

120 KBs Word File