Fishel Company is working on two job orders. The job cost sheets show the following: Prepare the

Question:

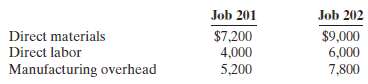

Fishel Company is working on two job orders. The job cost sheets show the following:

Prepare the three summary entries to record the assignment of costs to Work in Process from the data on the job costsheets.

Transcribed Image Text:

Job 201 Job 202 Direct materials Direct labor Manufacturing overhead $7,200 $9,000 6,000 5,200 7,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

The three summary entries are Work in Process Inventory 7200 9000 ...View the full answer

Answered By

Issa Shikuku

I have vast experience of four years in academic and content writing with quality understanding of APA, MLA, Harvard and Chicago formats. I am a dedicated tutor willing to hep prepare outlines, drafts or find sources in every way possible. I strive to make sure my clients follow assignment instructions and meet the rubric criteria by undertaking extensive research to develop perfect drafts and outlines. I do this by ensuring that i am always punctual and deliver quality work.

5.00+

6+ Reviews

13+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Managerial Accounting questions

-

9 0.5 points A population is made up of individuals where 37 have the A1A1 genotype, 15 have the A1A2 genotype, and 27 have the A2A2 genotype. What is the observed A1 allele frequency? Answer to 2...

-

Francisco Company is working on two job orders. The job cost sheets show the following: Prepare the three summary entries to record the assignment of costs to Work in Process from the data on the job...

-

Milner Company is working on two job orders. The job cost sheets show the following. Prepare the three summary entries to record the assignment of costs to Work in Process from the data on the job...

-

Assume that investment spending depends only on the interest rate and no longer depends on output. Given this information, a decrease in money supply: a. will cause investment to increase. b. may...

-

The liabilities and shareholders' equity items (in millions) that follow were taken from the March 31, 2016, balance sheet for Saputo Inc.: Accounts payable and accrued...

-

The following information is available for Randall Inc. Accounts receivable............................................. $ 2,400 Cash..................................................... $ 6,250...

-

22-2. Qu importancia tiene la forma de S de la funcin de respuesta de ventas en la figura 22-1?

-

During 2017 the Lung Association received a contribution of marketable securities that were to be placed in a permanent endowment fund. Neither donor stipulations nor applicable state law requires...

-

PSa 5 - 5 Calculate FUTA and SUTA Tax For each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer: NOTE: For simplicity, all calculations throughout...

-

Puget Sound Divers is a company that provides diving services such as underwater ship repairs to clients in the Puget Sound area. The companys planning budget for May appears below: Required: During...

-

During the current month, Barnum Company incurs the following manufacturing costs: a. Purchased raw materials of $13,000 on account. b. Incurred factory labor of $40,000. Of that amount, $31,000...

-

During the current month, Seeza Corporation completed Job 310 and Job 312. Job 310 cost $60,000 and Job 312 cost $40,000. Job 312 was sold on account for $90,000. Journalize the entries for the...

-

What are the 5 Cs of credit that are sometimes used by bankers and others to determine whether a potential loan will be repaid?

-

Evaluation a. Evaluate the effectiveness of social media marketing campaign for instagram, facebook and pintrest ?based on your KPIs for example account reached, content reached, likes, shares,...

-

A study was performed at a university to analyze whether the preference for hamburgers or fried chicken is related to the gender of the student. This table lists the results of the study. At a =...

-

A 20-lb homogeneous box has tipped and is resting against a 40-lb homogeneous box as shown in figure attached. The coefficient of friction between box A and the floor is 0.7, and between box B and...

-

The Taylor series for natural logarithm (with base e) In(1+r) is In(1+2) -(-1)+1 for <1. (a) Write a user-defined function using loop that determines In(1+x) using the above Taylor series. Your...

-

Question 1: [up to 4 pts] Suppose that a = 1, a2 = 2, a3 = = 3, and an = an-3 for all n 4. If an integral with respect to y is used to find the area of R, what should the upper limit of integration...

-

Identify the methods organizations use for employee development.

-

9.Consider the reaction 3NO2(g)+H2O=2HNO3(aq)+NO(g) where Delta H=-137 kJ.How many kilojoules are released when 92.3g of NO2 reacts?

-

It always takes energy to remove an electron from an atom, no matter what n shell the electron is in. Also, the higher the n, the more energy an electron starts out with. (a) Explain why it takes...

-

Happy Cat, Inc., makes two lines of cat food: (1) Tabby Treat, and (2) Fresh n Fishy. The Tabby Treat line is a dry food that is processed almost entirely by an automated process. Fresh n Fishy is a...

-

Happy Cat, Inc., makes two lines of cat food: (1) Tabby Treat, and (2) Fresh n Fishy. The Tabby Treat line is a dry food that is processed almost entirely by an automated process. Fresh n Fishy is a...

-

Classic Cabinets has one factory in which it produces two product lines. Walter manages the Wood Division, which produces wood cabinets, and Mary manages the Metal Division, which produces metal...

-

Practicum Co. pad $1.2 million for an 80% interest in the common stock of Sarong Co. Practicum had no previous equity interest in Sarong. On the acquisition date, Sarong's identifiable net assets had...

-

On Dec 31 2020, Bernice Melson, a partner in ABC Communications, had an ending capital balance of $49,000. Her share of the partnership's profit was $18,000; she made investments of $12,000 and had...

-

Q2R. on account for each depreciable asset. During 2024, Jane VIIS nsactions.) i More Info Apr. 1 Purchased office equipment. 5111,000. Paid 581,000 cash and financed the remainder Jan. 1 with a note...

Study smarter with the SolutionInn App