Gig Harbor boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the

Question:

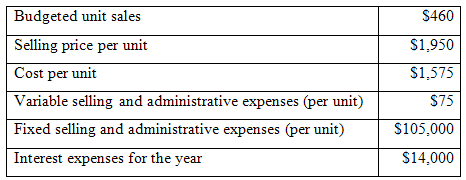

Gig Harbor boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process

Required:

Prepare the company’s budgeted income statement. Use the absorption costing income statement format shown in Schedule 9.

Transcribed Image Text:

Budgeted unit sales S460 Selling price per unit Cost per unit S1,950 $1,575 Variable selling and administrative expenses (per unit) $75 Fixed selling and administrative expenses (per unit) S105,000 Interest expenses for the $14,000 year

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (20 reviews)

Gig Harbor Boating Budgeted Income Statement Sales 460 units ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Question Posted:

Students also viewed these Managerial Accounting questions

-

Seattle Cat is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit sales . ....

-

Seymour Inc. has prepared the following summary quality cost report for 2010: Prevention costs ......... $1,560,000 Appraisal costs ......... 1,800,000 Internal failure costs ....... 2,280,000...

-

Litton decided to purchase photocopiers to use in its offices. Angelo Buquicchio, a Royal (a division of Litton) salesperson, recommended that Litton lease the machines from Regent. Regent was a...

-

The rigid bars ABC and CD are supported by pins at A and D and by a steel rod at B. There is a roller connection between the bars at C. Compute the vertical displacement of point C caused by the...

-

In one variation of a study conducted by Privitera, Cooper, and Cosco (2012), participants were asked to eat fast or slow, and the amount consumed in their meal was recorded. In this study (M SD),...

-

Based on the following information, calculate the sustainable growth rate for Hendrix Guitars, Inc.: Profit margin = 6.3% Total asset turnover = 1.75 Total debt ratio = .35 Payout ratio = 30%

-

P3-3 Allocating excess of investment On March 31, 2014, Tobias AG purchased 90 percent of interest in Mark AG for $8,100,000 cash. Mark AG had unrecorded patents on this date for $100,000. The...

-

The Enron debacle created what one public official reported was a crisis of confidence on the part of the public in the accounting profession. List the parties who you believe were most responsible...

-

Problem 8-6 Crane Company is a multi product firm. Presented below is information concerning one of its products, the Hawkeye. Date Transaction Quantity Price/Cost 1/1 Beginning inventory 2,700 $17...

-

How would you classify Barbie as a productas a convenience, shopping, or specialty product? Discuss why you chose that particular classification given the amount of shopping effort required by...

-

Garden depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: The companys beginning cash balance for...

-

The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year: The beginning balance...

-

What were some of the risk sources that emerged repeatedly in evaluating the risks? How is this helpful?

-

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is...

-

Briefly describe the case you have chosen. Categorize the social worker's experience as vicarious trauma, compassion fatigue, or burnout. Provide justification. Identify the social worker's score on...

-

Given f(x) below, find f'(x). f(x) = = m 5z In (2) et dt

-

Olsen & Alain, CPAs (O&A) performed the audit of Rocky Point Brewery (RPB), a public company in 20X1 and 20X2. In 20X2, O&A also performed tax services for the company. Which statement best describes...

-

Exercise 9-4 (Algo) Prepare a Flexible Budget Performance Report [LO9-4] Vulcan Flyovers offers scenic overflights of Mount Saint Helens, the volcano in Washington State that explosively erupted in...

-

The big advantage of telephone interviewing is its low cost and rapid response. TF

-

Give the products of the following reaction, where T is tritium: dioldehydrase Ad- CH CH3C-COH CoIII) coenzyme B12

-

Is the Earths magnetic field parallel to the ground at all locations? If not, where is it parallel to the surface? Is its strength the same at all locations? If not, where is it greatest?

-

A small-business corporation is considering whether to replace some equipment in the plant. An analysis indicates there are five alternatives in addition to the do-nothing option, Alt. A. The...

-

A corporation with $7 million in annual taxable income is considering two alternatives: Before-Tax Cash Flow Year Alt. 1 Alt. 2 0 -$10,000 -$20,000 1-10 4,500 4,500 11-20 0 4,500 Both alternatives...

-

Two mutually exclusive alternatives are being considered by a profitable corporation with an annual taxable income between $5 million and $10 million. Before-Tax Cash Flow Year Alt. A Alt. B 0 -$3000...

-

Suppose you bought a bon with an annual coupon rate of 6.5 percent one year ago for $1,032. The bond sells for $1,020 today. a. Assuming a $1,000 face value, what was your total dollar return on this...

-

During the year 2021, William has a job as an accountant, he earns a salary of $100,000. He has done some cleaning services work on his own (self-employed), where he earned a net income of $50,000....

-

Fixed cost per unit is $7 when 25,000 units are produced and $5 when 35,000 units are produced. What is the total fixed cost when 30,000 units are produced? Group of answer choices $150,000....

Study smarter with the SolutionInn App