( Goodwill , Impairment) On July 31, 2010, Mexico Company paid $3,000,000 to acquire all of the...

Question:

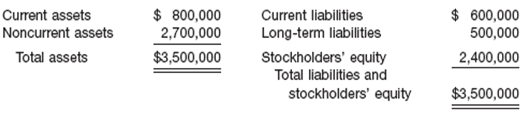

(Goodwill, Impairment) On July 31, 2010, Mexico Company paid $3,000,000 to acquire all of the common stock of Conchita Incorporated, which became a division of Mexico. Conchita reported the following balance sheet at the time of the acquisition.

It was determined at the date of the purchase that the fair value of the identifiable net assets of Conchita was $2,750,000. Over the next 6 months of operations, the newly purchased division experienced operating losses. In addition, it now appears that it will generate substantial losses for the foreseeable future. At December 31, 2010, Conchita reports the following balance sheet information.

Current assets.........................................................................................$ 450,000

Noncurrent assets (including goodwill recognized in purchase)......2,400,000

Current liabilities.....................................................................................(700,000)

Long-term liabilities.................................................................................(500,000)

Net assets..............................................................................................$1,650,000

It is determined that the fair value of the Conchita Division is $1,850,000. The recorded amount for Conchita's net assets (excluding goodwill) is the same as fair value, except for property, plant, and equipment, which has a fair value $150,000 above the carrying value.

(a) Compute the amount of goodwill recognized, if any, on July 31, 2010.

(b) Determine the impairment loss, if any, to be recorded on December 31, 2010.

(c) Assume that fair value of the Conchita Division is $1,600,000 instead of $1,850,000. Determine the impairment loss, if any, to be recorded on December 31, 2010.

(d) Prepare the journal entry to record the impairment loss, if any, and indicate where the loss would be reported in the incomestatement.

Goodwill, Impairment) On July 31, 2010, Mexico Company paid $3," class="fr-fic fr-dii">

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield