Happy Times currently has an all-cash policy. It is considering making a change in the credit policy

Question:

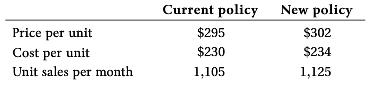

Happy Times currently has an all-cash policy. It is considering making a change in the credit policy by going to terms of net 30 days. Based on the following information, what do you recommend? The required return is 0.95 percent per month.

Transcribed Image Text:

Price per unit Cost per unit Unit sales per month Current policy $295 $230 1,105 New policy $302 $234 1,125

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (14 reviews)

The cash flow from the old policy is Cash flow from old policy 295 2301105 Cash f...View the full answer

Answered By

Geoffrey Isaboke

I am an industrious tutor with a 5-yr experience in professional academic writing. I have passion for History and Music and I have good knowledge in Economics

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 978-0071339575

7th Canadian Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Gordon Ro

Question Posted:

Students also viewed these Corporate Finance questions

-

Happy Times currently has an all-cash credit policy. It is considering making a change in the credit policy by going to terms of net 30 days. Based on the following information, what do you...

-

Happy Times currently has an all-cash credit policy. It is considering making a change in the credit policy by going to terms of net 30 days. Based on the following information, what do you...

-

Happy Times currently has an all-cash credit policy. It is considering making a change in the credit policy by going to terms of net 30 days. Based on the following information, what do you...

-

In a survey of 1,002 people, 701 (or 70%) said that they voted in the last presidential election (based on data from ICR Research Group). The margin of error was 3 percentage points. However, actual...

-

Using the extended asset market or portfolio balance model presented in Section 15.4b examine the portfolio adjustment resulting from an increase in the supply of the foreign bond because of the...

-

Question 4 2 pts Pineapple, an individual, expects his U.S. based C corporation to generate a profit of $2,900,000. What is Pineapple's after-tax cash flow from the corporation if net income after...

-

C8.4. Inaccounting fur theconversion ofconvertible bondstocommon stock,mostfirms recordthe issueof sharesat theamount of thebookvalueof the bonds. The issue of the sharescouldbe recorded at their...

-

A company sends a random sample of 16 of its salespeople to a course designed to increase their motivation and, hence, presumably their effectiveness. In the following year these people generated...

-

Castor Incorporated is preparing its master budget. Budgeted sales and cash payments for merchandise purchases for the next three months follow. \ table [ [ Budgeted , April,, ] , [ Sales , $ 5 7 , 6...

-

1. Using the post-acquisition integration matrix, Figure 11.3, compare Googles early style of acquisition management with the integration of Nest. 2. How has Google managed to be successful in...

-

You place an order for 400 units of inventory at a unit price of $125. The supplier offers terms of 1/10, net 30. a. How long do you have to pay before the account is overdue? If you take the full...

-

The Tate Corp. has annual sales of $34 million. The ACP is 33 days. What is the average investment in accounts receivable as shown on the balance sheet?

-

Dillon Corp. issued \(\$ 100,000\) of \(6 \%\) (cash payable each December 31), 10 -year bonds on January 1, 2020. The bonds are callable at any point after 2024 at 103. The bonds sold on January 1,...

-

What are major initiatives would you expect to see in a strategic plan focusing on a public health organization?

-

The purchase of \(\$ 500\) of supplies on account will: a. Increase both assets and stockholders' equity by \(\$ 500\) b. Increase assets and decrease liabilities by \(\$ 500\) c. Increase assets and...

-

Venus Company owned a service truck that was purchased at the beginning of 2011 for \(\$ 20,000\). It had an estimated life of three years and an estimated salvage value of \(\$ 2,000\). Venus uses...

-

You are observing the sales department staff using exponential smoothing to fore- cast monthly sales. Their forecast for January's sales was 12,000 units. January's actual sales figure became...

-

Use the ID3 algorithm to build the full decision tree for the data set given in Section 10.9.2. 10.9.2 Example We will start with the training data given below: Film Country of origin Big star Genre...

-

What distinguishes preliminary surveys from other audit preparation?

-

Is it ethical to provide safety training in English to immigrant workers who speak little English, in order to reduce costs?

-

Geoffrey's income for 2023-24 comprises a salary of 114,600 and dividends received of 4,400. He makes qualifying Gift Aid donations of 7,200 during the year. Calculate his 2023-24 income tax...

-

Payback Period concerning payback: a. Describe how the payback period is calculated, and describe the information this measure provides about a sequence of cash flows. What is the payback criterion...

-

Discounted Payback Concerning discounted payback: a. Describe how the discounted payback period is calculated, and describe the information this measure provides about a sequence of cash flows. What...

-

Discounted Payback Concerning discounted payback: a. Describe how the discounted payback period is calculated, and describe the information this measure provides about a sequence of cash flows. What...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App