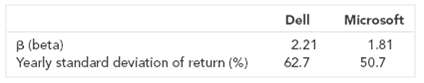

Here are some historical data on the risk characteristics of Dell and Microsoft: Assume the standard deviation

Question:

Here are some historical data on the risk characteristics of Dell and Microsoft:

Assume the standard deviation of the return on the market was 15 percent.

a. The correlation coefficient of Dell?s return versus Microsoft?s is .66. What is the standard deviation of a portfolio invested half in Dell and half in Microsoft?

b. What is the standard deviation of a portfolio invested one-third in Dell, one-third in Microsoft, and one-third in Treasury bills?

c. What is the standard deviation if the portfolio is split evenly between Dell and

Microsoft and is financed at 50 percent margin, i.e., the investor puts up only 50 percent of the total amount and borrows the balance from the broker?

d. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of 2.21 like Dell? How about 100 stocks like Microsoft?

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers