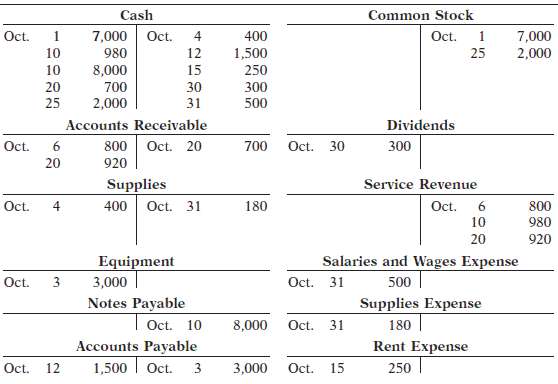

Here is the ledger for Stampfer Co. Instructions(a) Reproduce the journal entries for only the transactions that

Question:

Here is the ledger for Stampfer Co.

Instructions(a) Reproduce the journal entries for only the transactions that occurred on October 1,10, and 20, and provide explanations for each.(b) Prepare a trial balance at October 31, 2012.

Transcribed Image Text:

Cash Common Stock 400 1,500 7,000 Oct. 1 7,000 Oct. 4 Oct. 1 10 980 12 25 2,000 10 8,000 15 250 20 700 30 300 500 25 2,000 31 Dividends Accounts Receivable 800 Oct. 20 Oct. 30 Oct. 6. 700 300 20 920 Supplies Service Revenue 400 Oct. 31 Oct. 180 Oct. 6. 800 10 980 20 920 Salaries and Wages Expense Oct. 31 Equipment Oct. 3,000 500 Supplies Expense 180 | Rent Expense Notes Payable I Oct. 10 Oct. 31 8,000 Accounts Payable 3,000 Oct. 12 1,500 Oct. Oct. 15 250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (18 reviews)

a Oct 1 Cash 7000 Common Stock 7000 Issued stock for cash 10 Cash 980 Ser...View the full answer

Answered By

Ashish Bhalla

I have 12 years work experience as Professor for Accounting, Finance and Business related subjects also working as Online Tutor from last 8 years with highly decentralized organizations. I had obtained a B.Com, M.Com, MBA (Finance & Marketing). My research interest areas are Banking Problem & Investment Management. I am highly articulate and effective communicator with excellent team-building and interpersonal skills; work well with individuals at all levels.

4.80+

17+ Reviews

46+ Question Solved

Related Book For

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Accounting questions

-

Here is the ledger for Kriscoe Co. Instructions (a) Reproduce the journal entries for only the transactions that occurred on October 1, 10, and 20, and provide explanation for each. (b) Prepare a...

-

Here is the ledger for Keisler Co. Instructions (a) Reproduce the journal entries for only the transactions that occurred on October 1, 10, and 20, and provide explanations for each. (b) Prepare a...

-

Here is the ledger for Kriscoe Co. Instructions a. Reproduce the journal entries for only the transactions that occurred on October 1, 10, and 20, and provide explanations for each. b. Prepare a...

-

In Exercises 8194, begin by graphing the absolute value function, f(x) = |x| . Then use transformations of this graph to graph the given function. h(x) = x +31-2

-

A 400-kg satellite has been placed in a circular orbit 1500 km above the surface of the earth. The acceleration of gravity at this elevation is 6.43 m / s2. Determine the linear momentum of the...

-

Evaluate the integral. TT/6 0 1 + cos 2x dx

-

What is the equilibrium decision of the firm concerning the hiring of labor? Why is this decision an equilibrium condition? Explain.

-

1. Critique the performance of JCSS management in the purchase of this system. 2. The implementation problems illustrated in this case may occur when you obtain a system by having your IS department...

-

Morganton Company makes one product, and has provided the following information to help prepare the master budget for its first four months of operations a. The budgeted selling price per unit is...

-

Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2021 2020 Cash $ 110,342 $ 89,775...

-

Selected transactions from the journal of Galaxy Inc. during its first month of operations are presented here. Instructions(a) Post the transactions to T accounts.(b) Prepare a trial balance at...

-

The bookkeeper for Bullwinkle Corporation made these errors in journalizing and posting.1. A credit posting of $400 to Accounts Receivable was omitted.2. A debit posting of $750 for Prepaid Insurance...

-

Refer to the information for Darby Corporation in E13-2. In E13-2 The following are selected 2017 transactions of Darby Corporation. Sept. 1 Purchased inventory from Orion Ltd. on account for...

-

Lucy is using a one-sample test based on a simple random sample of size = 24 to test the null hypothesis = 23.000 cm against the alternative hypothesis < 23.000 cm. The sample has mean 22.917 cm and...

-

A motorcyclist of mass 60 kg rides a bike of mass 40 kg. As she sets off from the lights, the forward force on the bike is 200N. Assuming the resultant force on the bike remains constant, calculate...

-

A load downward load P = 400 N is applied at B. It is supported by two truss members with member BA at an angle of 0 = 45 from horizontal and member BC at an 01 = angle of 02 25 from vertical....

-

Gross profit, defined as Net sales less Cost of products sold increased by $279 million in 2017 from 2016 and decreased by $2 million in 2016 from 2015. As a percent of sales, gross profit was 38.8%...

-

An electro-magnetic shield is to be made of galvanized steel with conductivity = 1.74 x 106 S/m, and magnetic permeability HR = 80. The thickness of cold rolled steel is in the following table. Gauge...

-

in what ways could the development of values of care be detrimental to an organisation?

-

Time Solutions, Inc. is an employment services firm that places both temporary and permanent workers with a variety of clients. Temporary placements account for 70% of Time Solutions' revenue;...

-

Work together to finish the following statement: You dont need Greek numerical prefixes when naming simple ionic compounds because . . .

-

An inexperienced accountant prepared this condensed income statement for Hight Company, a retail firm that has been in business for a number of years. HIGHT COMPANY Income Statement For the Year...

-

The trial balance of Save-Mart Wholesale Company contained the accounts shown at December 31, the end of the company's fiscal year. Adjustment data: 1. Depreciation is $12,000 on buildings and $9,000...

-

At the end of Kane Department Stores fiscal year on November 30, 2010, these accounts appeared in its adjusted trial balance. Freight-in .................. $ 5,060 Merchandise Inventory (beginning)...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App