Holbrook, a calendar year S corporation, distributes $15,000 cash to its only shareholder, Cody, on December 31.

Question:

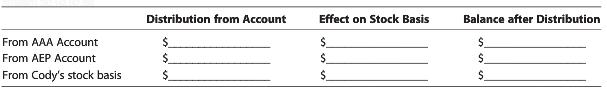

Holbrook, a calendar year S corporation, distributes $15,000 cash to its only shareholder, Cody, on December 31. Cody’s basis in his stock is $20,000, Holbrook’s AAA balance is $8,000, and Holbrook holds $2,500 AEP before the distribution. Complete the chart below.

Transcribed Image Text:

Distribution from Account Effect on Stock Basis Balance after Distribution From AAA Account From AEP Account From Cody's stock basis

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

A cash distribution from an S corporation with AEP comes first from the AAA l...View the full answer

Answered By

Benish Ahmad

I'm a professional software engineer. I'm lectutrer at GCUF and I have 3 years of teaching experience. I'm looking forward to getting mostly computer science work including:

Programming fundamentals

Object oriented programming

Data structures

object oriented design and analysis

Database system

Computer networks

Discrete mathematics

Web application

I am expert in different computer languages such as C++, java, JavaScript, Sql, CSS, Python and C#. I'm also have excellent knowledge of essay writing and research. I have worked in other Freelancing website such as Fiverr and Upwork. Now I have finally decided to join the SolutionInn platform to continue with my explicit work of helping dear clients and students to achieve their academic dreams. I deliver plagiarism free work and exceptional projects on time. I am capable of working under high pressure.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Corporations questions

-

Lonergan, Inc., a calendar year S corporation in Athens, Georgia, had a balance in AAA of $200,000 and AEP of $110,000 on December 31, 2017. During 2018, Lonergan, Inc., distributes $140,000 to its...

-

Zebra, Inc., a calendar year S corporation, incurred the following items this year. Sammy is a 40% Zebra shareholder throughout the year. Operating income ............... $100,000 Cost of goods sold...

-

Money, Inc., a calendar year S corporation, has two unrelated shareholders, each owning 50% of the stock. Both shareholders have a $400,000 stock basis as of January 1, and Money has AAA of $300,000...

-

Rhenium forms a series of solid oxides: Re2O7 (yellow), ReO3 (red), Re2O5 (blue), and ReO2 (brown). One of them has a crystal structure with the following unit cell: a. How many rhenium atoms (gray...

-

Chen recently graduated from college and accepted a job in a new city. Furnishing his apartment has proven more costly than he anticipated. To assist him with making purchases, he applied for and...

-

The objective of conducting a travel analysis is to a. determine the financial capacity of the prospect firm b. estimate the total annual utilization of a business aircraft c. provide a master plan...

-

Self-care behaviors among patients. A study in the Journal of Clinical Nursing (Vol. 29, 2020) examined the level of and identified factors affecting the self-care behaviors in patients with diabetic...

-

Normal Corporation uses standard costing and is in the process of updating its direct materials and direct labor standards for Product 20B. The following data have been accumulated: Direct materials...

-

Waterways Corporation is a private corporation formed for the purpose of providing the products and the services needed to Irrigate farms, parks, commercial projects, and private laws. It has a...

-

What insights from the discussion of the Morgan Stanley 2003 report on eBay apply to the 2013 report on Aetna by Jefferies? What insights from the discussion of the Morgan Stanley 2003 report on eBay...

-

Greiner, Inc., a calendar year S corporation, holds no AEP. During the year, Chad, an individual Greiner shareholder, receives a cash distribution of $30,000 from the entity. Chads basis in his stock...

-

Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land was purchased for $45,000 ten years ago and is currently...

-

Account balances for the Rob, Tom, and Val partnership on October 1, 2011, are as follows: The partners have decided to liquidate the business. Activities for October and November are as...

-

The adjusted trial balance section of Menlo Company's worksheet shows a \(\$ 1,500\) debit balance in utility expense. At the end of the accounting period the accounting manager accrues an additional...

-

Identify each of the 10 amount columns of the worksheet and indicate to which column the adjusted balance of the following accounts would be extended: a. Accounts Receivable b. Accumulated...

-

Using the data from Table 3.3, show the effect on world output if each country moved toward specialization in the production of its comparative-disadvantage good. TABLE 3.3 Comparative Advantage as a...

-

The Professional Winner was RJ Andrews from Info We Trust, for the video Are Gazelles Endangered? (a) Watch this video. What data are this video conveying? (b) You can interact with the data and...

-

(a) Draw a simplified ray diagram showing the three principal rays for an object located outside the focal length of a converging lens. (b) Is the image real or virtual? (c) Is it upright or...

-

Planets \(\mathrm{A}\) and \(\mathrm{B}\) are 10 light years apart in the reference frame of planet A. (One light year is the distance light travels in one year.) A deep-space probe is launched from...

-

A sample statistic will not change from sample to sample. Determine whether the statement is true or false. If it is false, rewrite it as a true statement.

-

Have you ever been on a team with a consistent contributor? What effect did that person have on the rest of the members? Was he or she treated like a sucker?

-

Do the stock attribution rules apply to all stock redemptions? Explain.

-

Cyan Corporation (E & P of $700,000) has 4,000 shares of common stock outstanding. The shares are owned as follows: Angelica, 2,000 shares; Dean (Angelica's son), 1,500 shares; and Walter (Angelica's...

-

Cyan Corporation (E & P of $700,000) has 4,000 shares of common stock outstanding. The shares are owned as follows: Angelica, 2,000 shares; Dean (Angelica's son), 1,500 shares; and Walter (Angelica's...

-

April corporations subchapter S election was voluntarily terminated for year 1. The first year that April would be eligible to reelect S corporation status is A. Year 2 B. Year 3 C. Year 4 D. Year 5

-

P 1 2 7 Acquisition in Multiple Steps LO 1 5 Peal Corporation issued 4 , 0 0 0 shares of its $ 1 0 par value stock with a market value of $ 8 5 , 0 0 0 to acquire 8 5 percent of the common stock of...

-

Eye Deal Optometry leased vision - testing equipment from Insight Machines on January 1 , 2 0 2 4 . Insight Machines manufactured the equipment at a cost of $ 2 0 0 , 0 0 0 and lists a cash selling...

Study smarter with the SolutionInn App