Homestake Mining Company is a 120-year-old international gold mining company with substantial gold mining operations and exploration

Question:

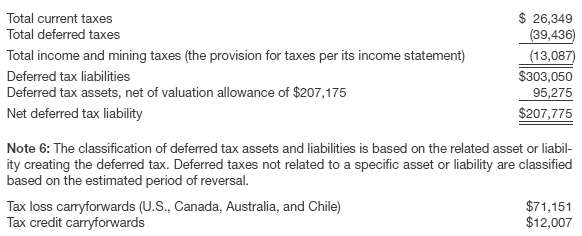

Homestake Mining Company is a 120-year-old international gold mining company with substantial gold mining operations and exploration in the United States, Canada, and Australia. At year-end, Homestake reported the following items related to income taxes (thousands of dollars).

Instructions(a) What is the significance of Homestake??s disclosure of ??Current taxes?? of $26,349 and ??Deferred taxes?? of $(39,436)?(b) Explain the concept behind Homestake??s disclosure of gross deferred tax liabilities (future taxable amounts) and gross deferred tax assets (future deductible amounts).(c) Homestake reported tax loss carryforwards of $71,151 and tax credit carryforwards of $12,007. How do the carryback and carryforward provisions affect the reporting of deferred tax assets and deferred taxliabilities?

Step by Step Answer: