In an economy there are two states of the world and four assets. You are given the

Question:

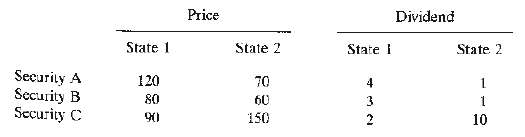

In an economy there are two states of the world and four assets. You are given the following prices for three of these securities in different states of the world:

?Current? prices for A, B, C are 100, 70, and 180, respectively.

(a) Are the ?current? process of the three securities arbitrage-free?

(b) If not, what type of arbitrage portfolio should one form?

(c) Determine a set of arbitrage-free prices for securities A, B, and C.

(d) Suppose we introduce a fourth security, which is a one-period futures contract written on B. is its price?

(e) Suppose a put option with strike price K = 125 is written on C.

The option expire in period 2. What is its arbitrage-free price?

Strike PriceIn finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity. Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci

Question Posted: