In each of the following independent situations, determine the valuation to be used for estate tax purposes

Question:

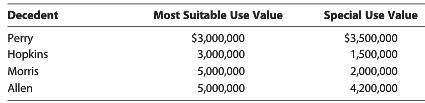

In each of the following independent situations, determine the valuation to be used for estate tax purposes if § 2032A is elected.

Transcribed Image Text:

Decedent Perry Hopkins Morris Allen Most Suitable Use Value $3,000,000 3,000,000 5,000,000 5,000,000 Special Use Value $3,500,000 1,500,000 2,000,000 4,200,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

Presuming the 2032a election otherw...View the full answer

Answered By

Issa Shikuku

I have vast experience of four years in academic and content writing with quality understanding of APA, MLA, Harvard and Chicago formats. I am a dedicated tutor willing to hep prepare outlines, drafts or find sources in every way possible. I strive to make sure my clients follow assignment instructions and meet the rubric criteria by undertaking extensive research to develop perfect drafts and outlines. I do this by ensuring that i am always punctual and deliver quality work.

5.00+

6+ Reviews

13+ Question Solved

Related Book For

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

Question Posted:

Students also viewed these Business Law questions

-

In each of the following independent situations, determine the amount of FICA (Social Security and Medicare) the employer should withhold from the employee's 2014 salary. a. Harry earns a $50,000...

-

In each of the following independent situations, determine the dividends received deduction. Assume that none of the corporate shareholders owns 20% or more of the stock in the corporations paying...

-

In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

Mrs. Ridhima had a factory situated in Delhi which he transferred to Uttar Pradesh and closed all operations in Delhi. Whether it will constitute a slump sale and whether it is liable to tax under...

-

Consider the following 16 observed values, rounded to the nearest tenth, from the exponential distribution that was given in this section: (a) Take re-samples of size n = 16 from these observations...

-

What are the major disadvantages of the normal net profit method for assigning common costs to a by-product? LO.1

-

Managers should consider only additional revenues and separable costs when making deci sions about selling now or processing further. Do you agree? Why?

-

Orasco Company uses both standards and budgets. For the year, estimated production of Product X is 500,000 units. Total estimated cost for materials and labor are $1,200,000 and $1,600,000. Compute...

-

QUESTION 55 Sydney gives his son, George, a gift of a house worth 350,000, in which his adjusted basis was 600,000. George subsequently sells the house for 650,000. As a result George will REALIZE a...

-

Fun & Games Corporation (Fun & Games or the Company) is a local toy store that sells all types of childrens toys and is based in Alexandria, Virginia. The Company has been in business since...

-

Assume the same facts as in Problem 32. Dale dies four years later when the trust is worth $6.1 million. Nicole is 38, and the applicable interest rate is 4.6%. a. How much as to the trust is...

-

At her death, Abigail owned 55% of the stock in Finch Corporation, with the balance held by family members. In the past five years, Finch has earned average net profits of $1.6 million, and on the...

-

For the following exercises, evaluate the binomial coefficient. 200 199

-

United States Historyassassination of Martin Luther King, Jr.

-

United States History-Burr-Hamilton duel duel, Weehawken, New Jersey, United States [1804]

-

United States HistoryBattle of Gettysburg American Civil War [1863] When and where was the Battle of Gettysburg fought?

-

United States History - United States presidential election of 1968 United States government

-

Salem witch trials American history What caused the Salem witch trials? How many people were killed during the Salem witch trials?

-

In a test of a technique of gender selection, the 100 babies born consist of at least 80 girls. Because there is about 1 chance in a billion of getting at least 80 girls among 100 babies, the results...

-

Grace is training to be an airplane pilot and must complete five days of flying training in October with at least one day of rest between trainings. How many ways can Grace schedule her flying...

-

On September 30, 2011, Ericson Company negotiated a two-year, 1,000,000 dudek loan from a foreign bank at an interest rate of 2 percent per year. It makes interest payments annually on September 30...

-

Suppose that a small business has close ties to one country, such as Iran, through family relationships. Isnt it unfair that the U.S. government embargoes that one country, making it impossible for...

-

Suppose that a business executive thinks that an embargo of one country is unfair. He sues. How is the suit likely to fare?

-

The court states that there are two key features to an irrevocable letter of credit (LOC). What are they?

-

Simpson Ltd is a small IT company, which has 2 million shares outstanding and a share price of $20 per share. The management of Simpson plans to increase debt and suggests it will generate $3 million...

-

The following are the information of Chun Equipment Company for Year 2 . ( Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated. ) Salaries...

-

Alta Ski Company's inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Beginning inventory, January 1, 2018 1,250 units...

Study smarter with the SolutionInn App