In this simulation, you are asked to address questions regarding the accounting for property, plant, and equipment.

Question:

In this simulation, you are asked to address questions regarding the accounting for property, plant, and equipment. Prepare responses to allparts.

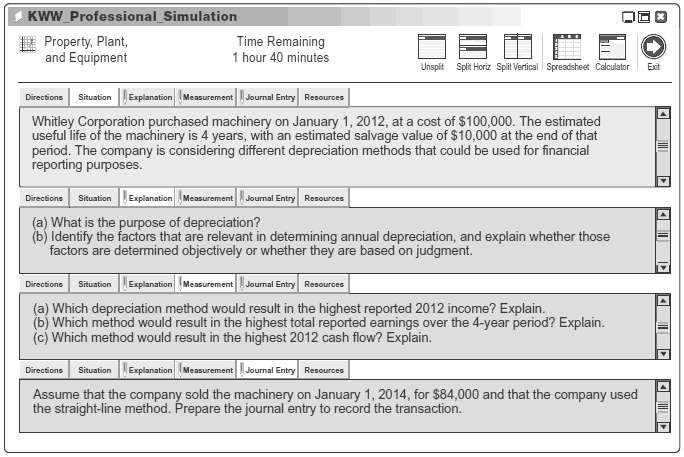

KWW Professional_Simulation 1 Property, Plant, and Equipment Time Remaining 1 hour 40 minutes Unspit Split Horiz Split Vertical Spreadsheet Calculator Exit Explanation IMeasurement Journal Entry Resources Situation Directions Whitley Corporation purchased machinery on January 1, 2012, at a cost of $100,000. The estimated useful life of the machinery is 4 years, with an estimated salvage value of $10,000 at the end of that period. The company is considering different depreciation methods that could be used for financial reporting purposes. Situation Explanation Measurement Joumal Entry Resources Directions What is the purpose of depreciation? (b) Identify the factors that are relevant in determining annual depreciation, and explain whether those factors are determined objectively or whether they are based on judgment. Situation Explanation Measurement Joumal Entry Resources Directions (a) Which depreciation method would result in the highest reported 2012 income? Explain. (b) Which method would result in the highest total reported earnings over the 4-year period? Explain. (c) Which method would result in the highest 2012 cash flow? Explain. Explanation Measurement Journal Entry Resources Directions Situation Assume that the company sold the machinery on January 1, 2014, for $84,000 and that the company used the straight-line method. Prepare the journal entry to record the transaction.

Step by Step Answer:

Explanation a The purpose of depreciation is to allocate the cost or other book value of tangible plant assets less salvage over their useful lives in a systematic and rational manner Under generally ...View the full answer

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Accounting questions

-

In this simulation, you are asked to address questions related to the accounting for leases. Prepare responses to all parts. (Round amounts to the nearestcent.) KWW Professional Simulation Time...

-

In this simulation, you are asked to address questions related to the accounting for stock options and earnings per share computations. Prepare responses to allparts. KWW Professional_Simulation...

-

In this simulation, you are asked to address questions related to the accounting for stockholders, equity. Prepare responses to allparts. KWW Professional Simulation Time Remaining Stockholders'...

-

An application program is executed on a nine-computer cluster. A benchmark program took time T on this cluster. Further, it was found that 25% of T was time in which the application was running...

-

What are the interest cost and the total amount due on a six-month loan of $1,500 at 13.2 percent simple annual interest?

-

An author has written 15 childrens books. The first eight books that she wrote contained between 240 and 250 pages each. The next six books contained between 180 and 190 pages each. Correct to 1...

-

In 1987 Stuart Corporation began operations issuing 100,000 shares of $1 par value common stock for $25 per share. Since that time the company has been very profitable. The stockhold ers equity...

-

Flex-Em began business in July 2013. The firm makes an exercise machine for home and gym use. Following are data taken from the firms accounting records that pertain to its first month of operations....

-

I need for help. Why 2019 is wrong? Thank you Comprehensive Problem 11-71 (LO 11-1, LO 11-2, LO 11-3, LO 11-4, LO 11-5, LO 11-6) [The following information applies to the questions displayed below.]...

-

Zhang incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the...

-

Matt Holmes recently joined Klax Company as a staff accountant in the controllers office. Klax Company provides warehousing services for companies in several Midwestern cities. The location in...

-

Toro Co. has equipment with a carrying amount of $700,000. The value-in-use of the equipment is $705,000, and its fair value less costs of disposal is $590,000. The equipment is expected to be used...

-

We can think of a cost or revenue estimate as a draw from many possible values of some distribution. Evaluate the following statement, "Variability is helpful in assessing the mean of the probability...

-

Conservation efforts include reintroduction of species into the wild from captive breeding programs. Leung et al. (2018) rewilded mice from the inbred laboratory strain of mouse, C57BL/6, that had...

-

The ending balance of the Accounts Receivable account was \(\$ 7,800\). Services billed to customers for the period were \(\$ 21,500\), and collections on account from customers were \(\$ 23,600\)....

-

Cash Flow Activity Classification Classify each activity as financing, investing, or operating: 1. Repay a loan from a bank. 2. Sell merchandise from a storefront operation. 3. Dispose of an old...

-

Generally Accepted Accounting Principles Select the best answer to each of the following MBC) questions: 1. Accounting rules are developed to provide: a. Simplicity b. Useful information c....

-

Basic Accounting Principles Identify whether the following statements are true or false. 1. Together the revenue recognition principle and the expense recognition (matching) principle define the...

-

3. For each situation in Question 2, what actions, if any, should the organization take? (LO 3-4)

-

Gopher, Inc. developing its upcoming budgeted Costs of Quality (COQ) with the following information: Expense Item Budget Raw Materials Inspection $ 15,000 EPA Fine 200,000 Design Engineering 15,000...

-

Hero Moto Corp Ltd. (Formerly Hero Honda Motors Ltd.) is the worlds largest manufacturer of two-wheelers, based in India. In 2001, the company had achieved the coveted position of being the largest...

-

When the equity method is applied, what amounts relate to the investment, and where will these amounts be reported in the financial statements?

-

When the equity method is applied, what amounts relate to the investment, and where will these amounts be reported in the financial statements?

-

Raleigh Corp. has an investment with a carrying value (equity method) on its books of 170,000 representing a 30% interest in Borg Company, which suffered a 620,000 loss this year. How should Raleigh...

-

question 6 Timely Inc. produces luxury bags. The budgeted sales and production for the next three months are as follows july. august september Sales, in units 1,115. 1229. 1302 Production. in units...

-

On May 12 Zimmer Corporation placed in service equipment (seven-year property) with a basis of $220,000. This was Zimmer's only asset acquired during the year. Calculate the maximum depreciation...

-

Power Manufacturing has equipment that it purchased 7 years ago for $2,550,000. The equipment was used for a project that was intended to last for 9 years and was being depreciated over the life of...

Study smarter with the SolutionInn App