In this chapter, you learned about equity financing and in Chapter 10 you learned about debt financing.

Question:

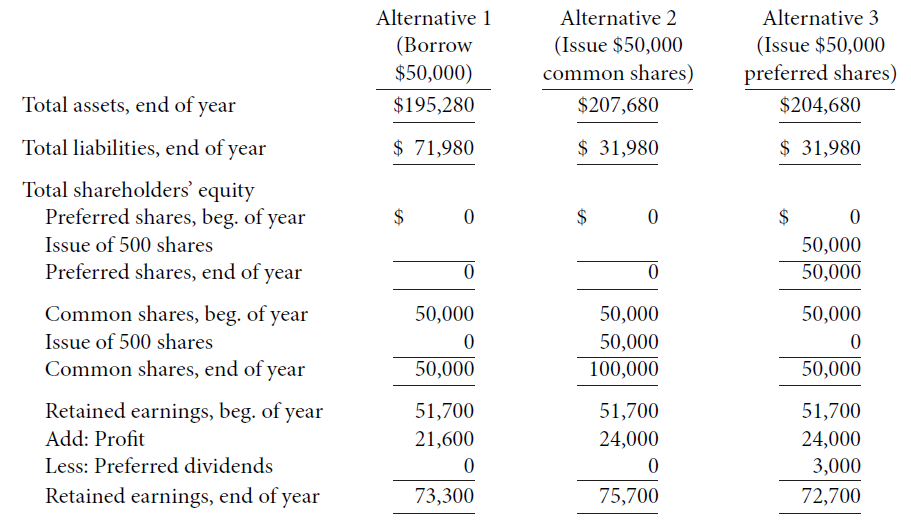

In this chapter, you learned about equity financing and in Chapter 10 you learned about debt financing. You are evaluating the financial statements of a private company that is considering purchasing equipment. You have prepared projected year-end financial statements using three different alternatives: (1) borrow $50,000 at the beginning of the year with repayment terms of $10,000 per year and interest at 6% per year; (2) issue 500 common shares for $100 per share ($50,000 in total) at the beginning of the year; and (3) issue 500 $6 noncumulative preferred shares for $100 per share ($50,000 in total) at the beginning of the year.

Selected information related to each of these three alternatives follows:

Instructions

(a) Using the information provided above, calculate the debt to total assets, return on common shareholders' equity, and earnings per share ratios for each alternative at the end of year.

(b) Based upon your calculations in part (a), which alternative(s) provides for the least amount of debt? Why?

(c) Which alternative provides for the highest return on common shareholders' equity? The highest earnings per share?

(d) If you were a shareholder at the beginning of the year, which alternative would you choose? Why?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine