In this exercise we work with the Black-Scholes setting applied to foreign currency denominated assets. We will

Question:

In this exercise we work with the Black-Scholes setting applied to foreign currency denominated assets. We will see a different use of Girsanov theorem. [for more detail see Musiela and Rutkowski (1997).] Let r,f denote the domestic and the foreign risk-free rates. Let St be the exchange rate, that is, the price of 1 unit of foreign currency in terms of domestic currency. Assume a geometric process for the dynamics of St;

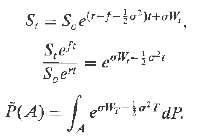

dSt = (r ? f)Stdt + ?StdWt.

(a) Show that where Wt is Wiener process under probability P.

(b) Is the process a martingale under measure P?

(c) Let P be the probability what does Girsonov theorem imply about the process, Wt ? ?t,

?under P?

?(d) shown using Ito formula that

dZt = Zt[(f ? r + ?2)dt ? ?dWt]

where Zt = 1/St.

(e) Under which probability is the process Ztert f eft a martingale?

(f) Can we say that P is the arbitrage-free measure of the foreign economy?

Step by Step Answer:

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci