JCPenney Company, Inc. discloses its inventory in the following manner on the balance sheet itself (dollars in

Question:

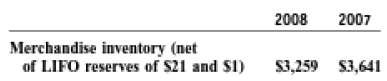

JCPenney Company, Inc. discloses its inventory in the following manner on the balance sheet itself (dollars in millions).

SUPERVALU, Inc., on the other hand, disclosed information about its LIFO and FIFO values in a footnote to its 2009 financial statements. The balance sheet inventory values (in millions) were $2,709 and $2,776 for 2009 and 2008, respectively.Approximately 81 percent and 82 percent of the company's inventories were valued using the last-in, first-out (LIFO) method inventories for fiscal 2009 and 2008, respectively. The first-in, first-out (FIFO) method is primarily used to determine cost for some of the remaining highly perishable inventories. If the FIFO method had been used to determine cost of inventories for which the LIFO method is used, the company's inventories would have been higher by approximately $258 million at February 28, 2009, and $180 million at February 23, 2008.REQUIRED:a. For which of the two companies is the difference between LIFO and FIFO larger as a percent of total inventories?b. Compute ending inventory as of the end of 2008, assuming the FIFO method, for JCPenney and as of the end of 2009 for SUPERVALU.c. Estimate the tax savings enjoyed by the two companies due to their use of LIFO instead of FIFO.d. Why might SUPERVALU use FIFO for "highly perishable inventories"?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: