Joe Albright owns and operates a small chain of convenience stores in Waterloo and Cedar Rapids. The

Question:

Joe Albright owns and operates a small chain of convenience stores in Waterloo and Cedar Rapids. The company has five stores including a downtown store and a Sumner store in the Waterloo division, and a downtown store, a Solon store, and an airport store in the Cedar Rapids division. There is also a separate administrative staff that provides market research, personnel, and accounting and finance services.

The company had the following financial results for 20X1 (in thousands):

Sales revenue ……………….. $8,000

Cost of merchandise sold ……. 3,500

Gross margin ………………… 4,500

Operating expenses ………….. 2,200

Income before income taxes … $2,300

The following data about 20X1 operations were also available:

1. All five stores used the same pricing formula; therefore, all had the same gross margin percentage.

2. Sales were largest in the two downtown stores, with 30% of the total sales volume in each.

The Solon and airport stores each provided 15% of total sales volume, and the Sumner store provided 10%.

3. Variable operating costs at the stores were 10% of revenue for the downtown stores. The other stores had lower variable and higher fixed costs. Their variable operating costs were only 5% of sales revenue.

4. The fixed costs over which the store managers had control were $125,000 in each of the down-town stores, $180,000 at Solon and airport, and $40,000 at Sumner.

5. The remaining $910,000 of operating costs consisted of

a. $210,000 controllable by the Cedar Rapids division manager but not by individual stores,

b. $100,000 controllable by the Waterloo division manager but not by individual stores, and

c. $600,000 controllable by the administrative staff.

6. Of the $600,000 spent by the administrative staff, $350,000 directly supported the Cedar Rapids division, with 20% for the downtown store, 30% for each of the Solon and airport stores, and 20% for Cedar Rapids operations in general. Another $140,000 supported the Waterloo division, 50% for the downtown store, 25% for the Sumner store, and 25% supporting Waterloo operations in general. The other $110,000 was for general corporate expenses.

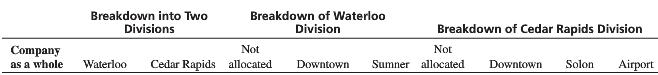

Prepare an income statement by segments using the contribution approach to responsibility accounting. Use the format of Exhibit 9-4, page 361w. Column headings should be as follows:

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta