Kate Torelli, a security analyst for Lion Fund, has identified a gold-mining stock (ticker symbol GMS) as

Question:

GMS is a highly leveraged company, so it is quite a risky investment by itself. Torelli is mindful of a passage from the annual report of a competitor, Baupost, which has an extraordinarily successful investment record: “Baupost has managed a decade of consistently profitable results despite, and perhaps in some respect due to, consistent emphasis on the avoidance of downside risk. We have frequently carried both high cash balances and costly market hedges. Our results are particularly satisfying when considered in the light of this sustained risk aversion.” She would therefore like to hedge the stock purchase—that is, reduce the risk of an investment in GMS stock.

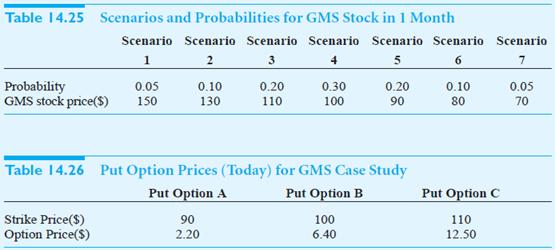

Currently GMS is trading at $100 per share. Torelli has constructed seven scenarios for the price of GMS stock one month from now. These scenarios and corresponding probabilities are shown in Table 14.25. To hedge an investment in GMS stock, Torelli can invest in other securities whose prices tend to move in the direction opposite to that of GMS stock. In particular, she is considering over-the-counter put options on GMS stock as potential hedging instruments. The value of a put option increases as the price of the underlying stock decreases. For example, consider a put option with a strike price of $100 and a time to expiration of one month. This means that the owner of the put has the right to sell GMS stock at $100 per share one month in the future. Suppose that the price of GMS falls to $80 at that time. Then the holder of the put option can exercise the option and receive $20. However, if the price of GMS rises to $100 or more, the option expires worthless.

Torelli called an options trader at a large investment bank for quotes. The prices for three European-style put options are shown in Table 14.26. Torelli wishes to invest $10 million in GMS stock and put options.

Questions

Questions1. Based on Torelli’s scenarios, what is the expected return of GMS stock? What is the standard deviation of the return of GMS stock?

2. After a cursory examination of the put option prices, Torelli suspects that a good strategy is to buy one put option A for each share of GMS stock purchased. What are the mean and standard deviation of return for this strategy?

3. Assuming that Torelli’s goal is to minimize the standard deviation of the portfolio return, what is the optimal portfolio that invests all $10 million? What are the expected return and standard deviation of return of this portfolio? How many shares of GMS stock and how many of each put option does this portfolio correspond to?

4. Suppose that short selling is permitted—that is, the non-negativity restrictions on the portfolio weights are removed. Now what portfolio minimizes the standard deviation of return?

Strike Price

In finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity. Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Data Analysis And Decision Making

ISBN: 415

4th Edition

Authors: Christian Albright, Wayne Winston, Christopher Zappe

Question Posted: