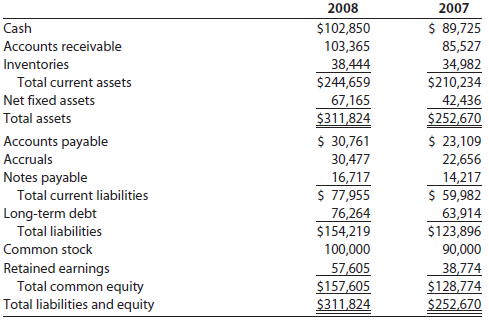

Laiho Industries 2007 and 2008 balance sheets (in thousands of dollars) are shown. a. Sales for 2008

Question:

Laiho Industries’ 2007 and 2008 balance sheets (in thousands of dollars) are shown.

a. Sales for 2008 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation and amortization were 11% of net fixed assets, interest was $8,575,000, the corporate tax rate was 40%, and Laiho pays 40% of its net income in dividends. Given this information, construct the firm’s 2008 income statement.

b. Construct the statement of stockholders’ equity for the year ending December 31, 2008, and the 2008 statement of cash flows.

c. Calculate 2007 and 2008 net working capital and 2008 free cash flow.

d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the company’s shareholders?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston